July 9, 2022

An In-Depth Guide on How To Create an e-Wallet App

Table of content

- An In-Depth Guide on How To Create an e-Wallet App

- What is a Digital Wallet App?

- How Does a Digital Wallet Work?

- Digital Wallets vs. Crypto Wallets

- Types of Digital Wallets

- Must-Have Features of the E-Wallet

- Steps in e-Wallet App Development

- How Much Does It Cost to Build an E-Wallet App?

- How Can Interexy Help?

- Final Thoughts

- FAQs

Both banking and financial sectors were forced to turn most of their regular services and products into a digital format. As a result, most financial companies started to provide various digital solutions designed for different purposes. However, the goal is only one – attract more customers, stay in demand and bring convenience to modern consumers.

The COVID-19 crisis made it possible for a complete digital transformation and sped up the process. According to Statista, digital and mobile wallet payments accounted for 29 percent of total transactions in physical stores worldwide, and the number is suggested to increase to 39 percent by 2024.

Researchers reported that the global mobile wallet market size is estimated to be worth $72 million in 2022. They also predict that the market revenue will reach $142 million by 2028, growing with a CAGR of 12.0% during the forecast period. Most well-known US banks are now actively shifting from tap-and-pay cards to digital wallets to increase customers’ loyalty and make it easier for them to use their services. The use of digital wallets globally is projected to spike by 70% by 2025.

Several famous services like Google Pay, Apple Pay, PayPal, and Samsung Pay are now working on bringing new digital solutions, which seems to boost the industry and speed up the process. In addition, experts believe that mobile commerce is expected to cover almost 80% of all e-commerce transactions by the end of 2025.

Let’s explore what digital wallets mean and how to create a mobile wallet app below with our guide:

What is a Digital Wallet App?

A digital wallet is a software, an electronic device, or/an online service that allows bank customers or businesses to perform transactions electronically. This software also stores the payment data of customers for different payment modes on different websites. A digital wallet is also called an e-wallet.

Even though traditionally digital wallets have been carried on smartphones, they now exist in other forms, like a desktop. However, the mobile app is now the most popular and most used version of an e-wallet. Digital wallets are not only more convenient and easy to use in most cases, but they are also safer compared to traditional wallets.

How Does a Digital Wallet Work?

Users who want to start using e-wallets should first download the specific apps made by banks or trusted third parties to use the service. The working mechanism of an e-wallet is based on the following principles:

- The e-wallet utilizes software to link your payment information from your connected bank account to the vendor that performs the transaction.

- Different types of applications will provide different types of access — open wallets (which are accepted by most retailers) allow for online purchases, contactless in-store payments, as well as cashback.

- Semi-closed and closed wallets provide certain transactions that lie in one group of retailers or only with the retailer that provides the wallet.

Digital Wallets vs. Crypto Wallets

Even though both have gained popularity during the last few years, crypto wallets differ from e-wallets. First of all, crypto wallets are specially designed to allow transactions with cryptocurrencies, yet they may store your fiat money as well.

Digital wallets are designed only for fiat money, and they can’t use cryptocurrencies for payments or any kind of transaction. Crypto wallets keep the passwords that give you access to your cryptocurrencies in a safe and easy way.

Types of Digital Wallets

Currently, there are three main types of digital wallets that are described below:

- Closed Wallet

A company that sells products or services can consider e-wallet app development known as a closed wallet. This type of wallet allows customers to use the funds stored to perform transactions with only the issuer of the wallet. The money that comes from returns, cancellations, or refunds is also stored in the wallets. A great life example of a closed wallet is Amazon Pay.

- Semi-Closed Wallet

A semi-closed wallet is a type that allows customers to perform transactions at available merchants and locations in the list. Even though the coverage area of this type of wallet is restricted, online and offline purchases can be made using this wallet. However, merchants must sign an agreement or contract with the issuers to effortlessly and legally accept payments from the mobile wallets.

- Open Wallet

Banks or trusted partners that have relationships with banks provide open wallets. Users who have open wallets can use them to perform all transactions allowed with a semi-closed wallet alongside withdrawal of funds from financial institutions and ATMs and transfer of funds.

Hire Developers

Let us choose the best specialist for you according to the project requirements so you can kick off the project within 5 business days!

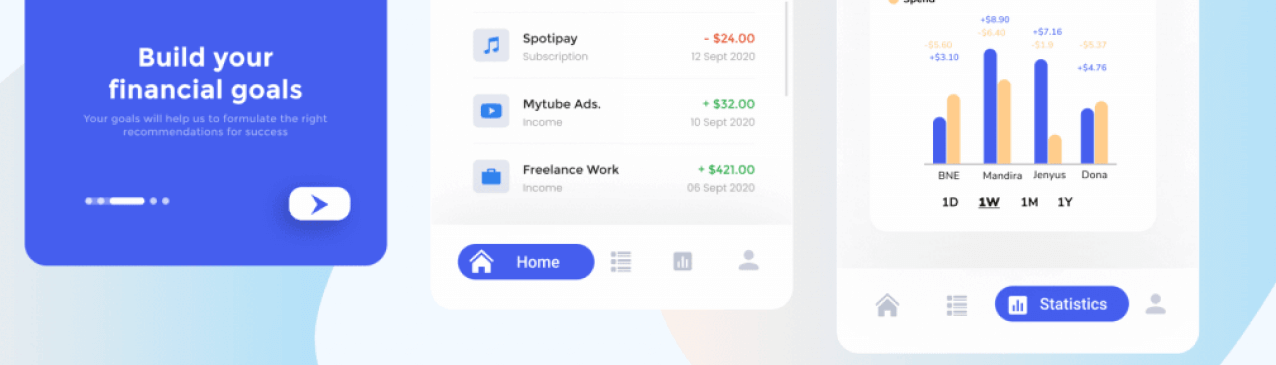

Book a callMust-Have Features of the E-Wallet

- Seamless Onboarding

When you wonder how to create a digital wallet, you should always focus on your future users. Therefore, the first thing they will see after downloading your app is registration. You will need to make it as simp;e and smooth as possible, as well as login and sign in. This is because your app will be used almost on a daily basis, so it should not be a challenge for users to perform the tasks they came for.

- QR-Code Based Payments

To make sure the payments can be made easily and effortlessly, you should pack your e-wallet with a QR-code scanner. Since social distance and people hygiene are becoming more popular, contactless payments provide higher user satisfaction.

- Add Money Via Bank or Cards

When starting e-wallet app development, you should decide how users will receive payments. This could be done by getting money from other users or adding money to their wallets. And there are two options on how they can add money to the wallet – via bank or debit/credit cards. And we also recommend you allow users to save the preferred method of adding money to their accounts.

- Instant Wallet Payments

It is one of the key features of your future e-wallet. The main idea behind this app is to provide payments instantly. And this is also the primary reason users will use your app.

- Payment History

Modern people always want to know every transaction happening with their money. Therefore, you should provide quick access to the history of payments. This will not only boost customer loyalty but also ensure higher transparency between your app and users.

- Account Management

This is a must-have feature that users will need to edit or update their bank account information, details about payments, cards, and preferences. However, you should ensure that every change that happens undergoes a strict verification process.

- Money Transfer

This feature will allow users to send money to other users of the application quickly. It has been shown to increase the number of users. To make it easier for users to use this feature, you can also integrate the app with the phone’s contacts. This allows customers to choose a person and send them money in just a few taps.

- Push Notifications

Push notifications are great for both sides. You help users stay informed about changes, updates of their transactions, when they receive money, or when they get rewards. It also allows you to keep engaged and boost retention rates.

- iBeacon and Bluetooth Integration

If you want to develop an e-wallet that can be used in physical stores, we recommend you integrate it with Bluetooth (and iBeacon for Apple devices) technology. In this case, whenever the user is in close proximity to Bluetooth beacons located in a shop, the phone will automatically open the app or send a notification about available deals.

Steps in e-Wallet App Development

1. Market Research

Any successful app development should always start with market research and competitor analysis. This stage is essential as you need to choose the industry, and target audience, perform a competitor analysis, and identify what the audience is looking for and how you can succeed.

2. App Concept Finalization

Once the market research is done, the next stage is to create and finish the app concept. This will not only help you clear your goals but also give the development company great help when creating business analysis and estimation.

3. Choosing App Development Company

If you don’t have an in-house team, you need to hire an experienced app development company that offers crypto app development services. Here are a few things you can consider when choosing your development provider:

- Start the search online on Clutch, ITFirms, Manifest, etc.

- Explore portfolio and customer reviews

- Perform interviews with several companies

- Ask about niche-specific experience

4. UX/UI Design

The design of the application will affect the first impression of the overall product. What users see and how they like it will affect whether they will use this app or not. However, it is vital to make sure the design team also has a relevant background in the niche to not only make the interface engaging but also suitable for e-wallets

5. Development

Once the design team provides wireframes and mockups, the development team you choose starts turning them into a working application and implementing all the necessary features. We advise you to use the Agile methodology when developing an app as it allows you to quickly enter the market and reduce costly mistakes.

6. App Launch & Promotion

After you launch the app to the market, you will need to think about marketing. However, it is always best to start creating a marketing plan during the first stage of the development process and then adjust it based on the final product. You should consider different platforms and campaigns to ensure the app will stand out from the crowd.

7. Ongoing Development & Support

The development process doesn’t stop at launch. Once first users leave their feedback, you will need to make changes. Collecting feedback is essential as it will allow you to see what users like and what doesn’t and provide changes accordingly. It is always vital to update your app by powering it with modern technologies when they appear or when new trends come into the picture.

See Our NFT & Blockchain Development Process

Download this file to see how we helped our NFT clients, how we can lead you to success and what process we use to achieve this

How Much Does It Cost to Build an E-Wallet App?

The cost of developing an eWallet mobile app highly depends on many factors, which include:

- Development Provider

- Location of the Development Company

- Experience and Background of developers

- App’s complexity and Features

- Type of Development Provider

However, when taking average features and companies, an e-wallet app development would range somewhere between $70k -$100k.

How Can Interexy Help?

Interexy is a trusted blockchain app development company in the USA, UAE that sets standards in the industry. Working with those companies and people who want to bring changes to the world with quality products, we provide only niche-specific resources for each and every product.

Our team is made up of driven minds with relevant experience, making it possible for each app developed by us to enter the market successfully and overcome competitors. By using our mobile wallets development services, you can be sure that your app will be developed by highly-skilled engineers, packed with every latest technology you want, of the highest quality and speed.

Book a Free Call!

Learn more about our expertise and get a detailed approach and solution for your specific case

Book a callFinal Thoughts

Today’s customers are looking for convenient and user-focused fintech products to perform daily financial operations. Therefore, this space constantly experiences changes and should always adopt new technologies to bring the best user experience and stay in demand. If you are looking for a trusted app development provider who can help you build a successful product, book a free call with our experts to discuss your idea!

FAQs

What is a digital wallet?

A digital wallet (e-wallet) refers to an electronic device that stores all your payment details in one place and helps you perform payments online.

How does a digital wallet work?

Digital wallets are linked to bank accounts, containing digital versions of your credit and debit cards, allowing you to store all the data in wallet apps on your mobile device.

How to make a digital wallet?

The development process comprises several steps, such as market research, choosing a development team, design, development, launch, marketing, and maintenance.