The insurance industry deals with various manual, monotonous, time-consuming, and paper-intensive tasks, such as filling out forms, managing data, and preparing reports. This ultimately leads to human error, slow decision-making, and poor customer experience.

Many providers use robotics process automation in insurance to optimize and accelerate everyday processes, boost efficiency, and achieve scalability. RPA in insurance, paired with AI and ML, drives sustainable business growth and provides new opportunities.

Today, embracing digital transformation is crucial for the survival and evolution of insurance companies.

$172.6 billion

$172.6 billion

The global InsurTech market size is expected to reach approximately $172.6 billion by 2030.

CAGR of 37.54%

CAGR of 37.54%

The global InsurTech market is forecast to grow at a CAGR of 37.54% from 2022 to 2030.

$1.2 billion

$1.2 billion

The global market for RPA in the insurance industry is predicted to hit $1.2 billion by 2031.

What is an RPA in Insurance?

Robotic process automation (RPA) in insurance means using low-code rules-based software bots to handle routine processes that don’t require strategizing or decision-making, such as policy creation, collecting customer data, performing background verification, etc.

RPA can be implemented with the help of healthcare web development and hardware systems used to solve a wide range of tasks, such as data collection and auto-filling forms. Automation in life insurance eliminates human errors and accelerates processes, which helps reduce the cost of labor and improve efficiency.

Why is Automation Required in the Insurance Industry?

-

Streamline time- and energy-consuming processes

Tedious manual processes, such as data input, confirming form accuracy, and report generation, hinder employees from focusing on more strategic and complex processes. Performing repetitive tasks ultimately results in slow processing, human errors, working overtime, and poor customer service.

-

Automate monotonous and paper-intensive tasks

RPA systems can assist with simple, extensive work, such as gathering, entering, retrieving, and collating data. The software can automate processes like providing receipts, form registration, entering form data into the system, and claims processing.

-

Delegate part of the workload

The software enables people to concentrate on tasks requiring human qualities, like judgment, reasoning, and emotional intelligence. Delegating part of the workload to bots and focusing on responsibilities requiring human intervention brings more value to robotic process automation insurance companies.

What are the Main Challenges Facing the Insurance Industry?

Regulatory Compliance

Cybersecurity Threats

Digital Disruption

Regulatory Compliance

The healthcare industry is subject to numerous rules and policies, such as HIPAA, HL7, meaning health insurance companies must work in compliance with the complex and evolving regulatory landscape.

This poses particular challenges, as the regulations vary at the national and state levels. The rules encompass consumer protection laws, privacy laws, and specific insurance industry guidelines. If insurers fail to comply with the regulations, they run the risk of being fined or even losing their operating license, not to mention legal disputes and reputation damage.

With the constantly changing regulatory environment, insurance providers must invest in compliance resources and expertise. Robotic process automation in life insurance helps in managing the risks effectively and staying on the safe side.

Not all companies providing healthcare software development services build compliant software solutions. That’s why it’s important to find a reliable development partner following all the necessary policies and guidelines. Companies can also hire external experts or legal advisors to stay updated with the latest legislation changes.

Cybersecurity Threats

The insurance industry stores and uses large volumes of sensitive customer data, so it remains a target for cyber attacks and data thefts. Hackers use vulnerabilities in insurance systems, especially legacy applications, to steal data, money, or intellectual property.

Insurance employees are often susceptible to phishing attempts as they deal with numerous files, emails, and links daily. Weak cybersecurity measures can lead to significant financial losses, damaged reputation, and customer distrust.

Insurance companies must keep their cybersecurity measures up to date to protect the data from breaches and fraud in the face of growing cyber threats. It’s crucial to invest in robust data protection tools, including RPA in healthcare insurance software, access control, and staff training. It’s also necessary to conduct regular vulnerability assessments to identify and predict possible security weaknesses.

Digital Disruption

Technological advancements have revolutionized the insurance industry, transforming the existing business models and enhancing customer experience. The rise of digital solutions, such as Machine Learning (ML), Artificial Intelligence (AI), Blockchain, and Big Data, has significantly contributed to the development of the insurance industry.

Despite numerous benefits of RPA software, not all insurance companies are eager to adopt it. Reluctance to change leaves them behind while their competitors enjoy streamlined operations and improved productivity.

However, robotic process automation in the insurance industry shouldn’t be seen as a hurdle but rather as one of the healthcare app ideas to expand your business. Investing in digital business transformation will optimize everyday processes, enable data analytics, and increase customer satisfaction.

Below you can explore the most widespread RPA case studies in insurance and how the technology transforms the industry.

Top 10 Use Cases of RPA in Insurance Industry

-

1 Underwriting

Underwriting and associated processes are among the most popular RPA use cases in insurance. RPA in life insurance can streamline lengthy processes of assessing and analyzing risks associated with insuring people and their property. Automating a range of processes accelerates decision-making and allows underwriters to allocate time to more complex tasks.

By leveraging ML, RPA and AI in insurance, the software can perform various tasks:

- Gather and access data from internal and external sources;

- Fill in the required data fields in the internal system;

- Analyze customer and asset background;

- Identify risky and fraudulent cases;

- Estimate losses, etc.

-

2 Claims Processing

Claims processing is a time-consuming and detail-oriented process involving a large amount of paperwork. It also requires excessive manual labor to gather data in various formats across channels and process claims promptly. RPA in insurance may simplify the following tasks:

- Data entry and retrieval;

- Claims verification;

- Error tracking;

- Identification and validation of fraudulent claims, etc.

Using RPA helps businesses accelerate data collection and retrieval and ensure timely payments. Automation software maintains a customer-centered approach and improves overall customer experience.

-

3 Analytics

Insurance companies seeking to streamline operations and enhance customer experience turn to process and business analytics. RPA can help track transactions, measure performance, and find areas for improvement, while manual labor and paper-based processes can hinder the analysis.

The RPA system keeps a record of all the transactions and operations, facilitating process analytics and enhancing business efficiency. This approach also speeds up customer response and claims processing time and optimizes operations.

-

4 Usage of Legacy Applications

Numerous insurance companies still use legacy applications in their everyday business processes. Such systems usually don’t communicate well with each other and are hard to integrate with newer BPM or ERP systems.

RPA software can act as a bridge connecting disparate legacy applications and new solutions through AI-based automation. RPA easily fits into the current workflow, complies with existing systems, and makes processes run more smoothly. The implementation streamlines processes, improves back-office efficiency, and, as a result, enhances customer experience.

-

5 Policy Administration

Policy administration encompasses bidding, quoting, rating, issuing, endorsing, and renewing policies. Multiple time-consuming processes can be an obstacle for scaling, especially considering the growing customer base.

RPA in the insurance sector can help optimize administrative and transactional tasks, such as accounting and tax settlements, credit control, regulatory compliance, risk capture, etc. Automation software significantly saves businesses time and money in the policy administration process.

-

6 Regulatory Compliance

The insurance industry is subject to thorough monitoring by regulatory authorities. Considering the large number of manual processes involved, insurance companies risk facing human errors and regulatory breaches. However, RPA systems automate data management processes, ensuring data accuracy and reliability. RPA can streamline various processes, including:

- Generating compliance reports and compliance checking;

- Researching and validating customer data;

- Sending notifications about account closure processing;

- Data security operations.

-

7 Query Resolution

Insurance companies receive endless customer inquiries that have to be quickly resolved. Timely and helpful resolution can be achieved with the help of RPA. These bots can interpret incoming calls and emails using a predetermined set of rules and natural language processing technology.

The system can address basic queries based on the predefined answers to frequently asked questions without human intervention. If the query is more complex, the bot forwards it to one of the employees.

-

8 Finance and Accounts

Insurance workers face such tasks daily as processing invoices and managing payroll and other financial transactions. Given the large amount of data they deal with, errors and inaccuracies can occur.

RPA software can eliminate manual labor by auto-filling templates, pressing buttons, copy-pasting data, filling in fields, etc. Insurance companies reduce transactional expenses and policy costs through automation of bank reconciliations.

-

9 Sales and Distribution

Manual processes connected with sales and distribution are costly, error-prone, and require a high level of maintenance. They are also time-consuming, as insurance workers have to obtain a quotation from several insurance carriers.

RPA can streamline everyday processes, like conducting legal, credit, and compliance checks, creating sales scorecards and funnel reports, and sending notifications to insurance agents. Using RPA for sales and distribution purposes helps achieve client satisfaction through timely delivery.

-

10 Policy Cancellation

Manual policy cancellation is a lengthy process involving calculating cancellation and inception dates, checking policy terms, and more. Insurers need to interact with various tools, such as email, a policy administration system, CRM, Excel, etc. RPA can quickly switch between the programs and complete all the necessary tasks within seconds.

Explore the Potential of Robotic Process Automation

What are the Benefits of RPA in Insurance?

-

Increased Data Accuracy

Automating manual operations with data helps minimize the risk of human errors and achieve the key RPA benefit in insurance – improved data accuracy and reliability. This can be helpful for insurance companies seeking scaling, as increased policyholder flow also means increased data volumes.

-

Faster Insurance Claims Processing

Claims processing is usually a lengthy process since employees collect information and documents from different departments and enter them into another system for processing. This long waiting time affects customer satisfaction. RPA bots can accelerate the process by managing large data volumes with just several clicks.

-

Expanded Business Opportunities

RPA applications are capable of analyzing large data volumes quickly, which helps spot patterns, anticipate future outcomes, and make data-driven decisions. Moreover, some RPA systems are integrated with Artificial Intelligence and Machine Learning and can simulate scenarios, assess risks and claims, and detect fraud. Adopting software with advanced features gives robotic process automation insurance companies a competitive advantage over others.

-

Cost Savings

RPA optimizes business operations, boosts efficiency, and increases overall productivity. Digital transformation automates and speeds up work processes, minimizing the need to work overtime. All of these factors contribute to cost reduction.

-

Higher Customer Satisfaction

RPA in health insurance optimizes and accelerates processes so insurance workers can deal with data-related tasks much faster. Instead, insurers can devote their time and attention to clients to understand and meet their needs.

Automating manual operations with data helps minimize the risk of human errors and achieve the key RPA benefit in insurance – improved data accuracy and reliability. This can be helpful for insurance companies seeking scaling, as increased policyholder flow also means increased data volumes.

How Can Interexy Help?

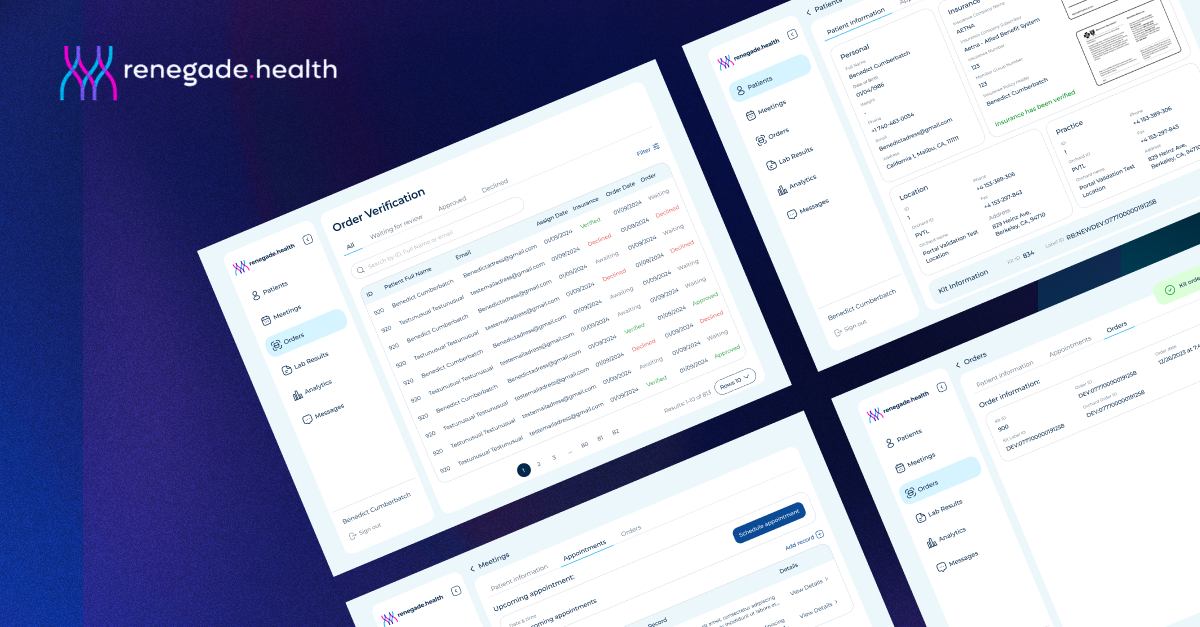

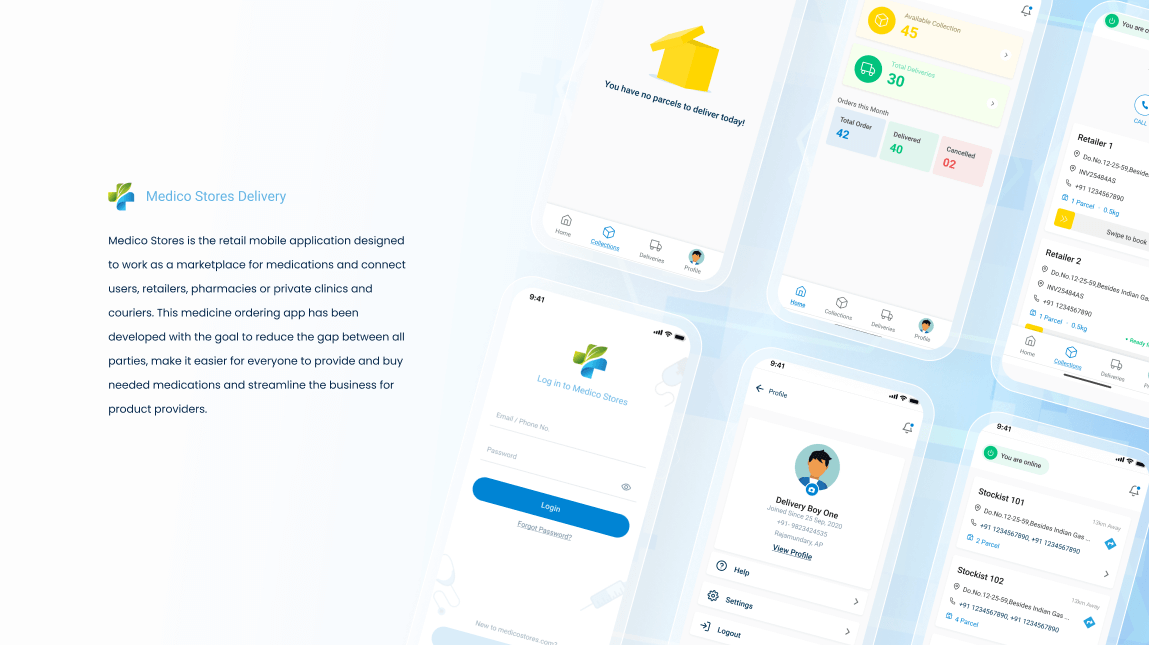

Interexy is a leading web & mobile telehealth app development company. We specialize in pharma and fitness app development and offer healthcare IT consulting services. Our team creates medical solutions for hospitals, clinics, and healthcare organizations wanting to increase data security and efficiency. All our products are developed in compliance with key healthcare regulations, such as HIPAA, HL7, XDS/XDS-I, etc.

Robotic Process Automation Software by Interexy

Final Thoughts

Using RPA allows insurance companies to gain a competitive edge and stay ahead of their colleagues. RPA software adoption streamlines and automates manual, time-consuming processes, making the data more accurate and reliable.

Optimization leads to costs and workload reduction, which is vital for business development. Insurers can spend more time on strategic tasks and provide clients with prompt, responsive, and personalized service. Therefore, insurance companies must embrace the technological changes and the benefits they have to offer.

FAQs

-

What is RPA in the insurance industry?

Robotics process automation in insurance refers to using low-code rules-based software bots to optimize repetitive manual tasks, such as collecting and retrieving customer data, policy creation and cancellation, performing background verifications, etc. RPA use cases in the insurance industry are endless.

-

How can insurance companies improve performance with the help of RPA?

RPA automates manual, monotonous, and paper-intensive processes connected with query resolution, policy administration, and cancellation. RPA in insurance underwriting significantly speeds up the process. The system adoption streamlines claims processing and enables business and process analytics. The software can also be used to optimize sales and distribution processes, finance, and accounts. RPA systems are seamlessly integrated with legacy applications and help companies operate in compliance with industry regulations.

-

How does RPA benefit insurance companies?

RPA adoption provides expanded business opportunities and streamlines business operations. With the help of the RPA software, insurance providers achieve increased data accuracy and accelerated processes, which leads to cost savings. Smooth and efficient workflow eventually results in higher customer satisfaction and improved customer experience.

-

What RPA system is most prevalent in insurance?

Among the most popular robotic process automation insurance use cases are the ones setting up software bots to perform repetitive operations, such as starting and controlling various other programs. They are generally used for collecting information, auto-filling forms, claims verification, canceling policies, etc.