December 22, 2021

FinTech Industry: How Financial Application Development Can Help You Build A Better Business

Table of content

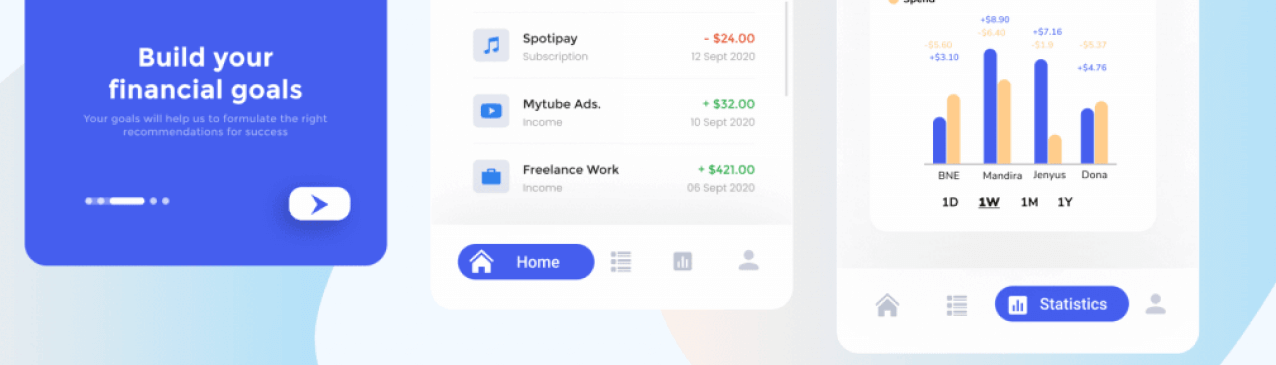

Fintech is the abbreviation for “financial technology” These applications represent modern technological advancements of products and services in the financial space worldwide. We curated this guide to walk you through what it is and how it can be used to boost your business. Every company’s owner is constantly looking for ways to improve inner processes and operations. This is where this technology comes into the picture bringing a hassle-free way to implement new digital solutions to help your brand grow rapidly and increase revenue.

Fintech mobile app development can provide your customers with the easiest and best online payment experience. Bringing ultimate convenience and supporting clients’ loyalty, you won’t be surprised to know that by the end of 2022, almost 78% of the United States (US) millennial population will tend to use digital banking.

Talking about the adoption of mobile transactions, China, India, the US, Japan, Italy, and the United Kingdom are now the top 6 countries. According to CACI Limited research, by the end of 2022, the adoption of these solutions will grow by 121%, ultimately involving approximately 88% of all banking transactions. Overall, online payments have become increasingly popular in the last few years, with a 250% revenue increase from 2020 to 2025.

So now it can be safely said that this industry is massive and widely supported by traditional banks. Based on the latest CB Insights, there are many 41 VC-backed startups who got a unicorn status worth a combined $154.1B. Although the driving fact for several years was that people always tend to convenience, COVID-19 also brought its massive impact. In days of complete lockdown and isolation, it is easier for companies to offer digitally-minded clients what they want while also boosting the industry with new implementations that will stay relevant and in-demand.

What is a FinTech?

Fintech is a term comprising words such as “finance” and “technology” that refers to any business applied technology to automate or improve financial processes. This word covers a quickly growing ecosystem that benefits both sides – customers and companies in various ways. Starting with mobile banking we use on a daily basis and insurance most people use, ending with blockchain and investment services, financial apps have an almost endless choice of potential uses.

Even though some people think that this technology appeared only a few years ago, Fintech is not a new term; it’s one that rocketed. These services have always been a great part of the financial world, whether it was the introduction of credit cards in the 1950s or ATMs and personal finance applications.

Resources and services used in financial technology vary from concept, project, and application. However, as practice shows, the latest advances use machine learning algorithms, data science, or blockchain to perform the most efficient functions, from processing credit risks to running hedge funds.

During the growth of this ecosystem, some companies have concerns regarding cybersecurity. This increased interest worldwide resulted in increased exposure of vulnerabilities in this infrastructure while making it a perfect victim of hackers. Nevertheless, technology is still growing, and every day utilizes new implementations that can significantly minimize existing fraud risks and reduce risks that also continue to arise.

How FinTech Apps affect the business

Access to funding and enhanced growth

Since all businesses need cash to grow and improve processes, fintech is the way to go. It helps companies to gain the funding they require working through online lending, making it mess-free, fast and secure. For instance, crowdfunding can provide you with an opportunity to get investments efficiently from many people even if you have never met them. These services offer solutions and open transparency that traditional banks can’t. So when you have these opportunities, you ultimately get access to cash to ensure you will be at the top of the competition.

Turn to cloud accounting

This refers to a platform making data and software accessible online anytime from anyplace and anytime. It helps owners stay linked to their data and personal accountants, providing needed information in real-time. If you want to make your processes work smarter and faster, fintech software is a wise investment.

Smart invoices and automated payments

Transferring money between borders is another thing that has been transformed by innovators. By turning your mobile phone into a POS system, millions of brands help manage their cash flow faster, easier and take payments. Automated management techniques also reduce the time-consuming tasks of manually handling money.

Top 5 best Fintech app ideas

Since this ecosystem is flourishing, companies invested in financial solutions can benefit from increased revenue, improved customer loyalty, and easier processes. Below we listed the five best trends in the Fintech industry that you can apply and enter the space with a great concept.

Mobile Wallets

It refers to a digital repository for a client’s payment information, including credit, rewards cards, bonuses, and coupons. These applications are in high demand, as they allow a user to make payments online or in retail stores with no hassle. Mobile wallets gained higher popularity during the COVID-19 pandemic representing a fundamental component of the digital payment revolution.

Faas and Saas solutions

Fintech-as-a-Service (FaaS) and banking-as-a-service (SaaS) refer to the approaches where organizations provide essences to have higher access to their products. According to the latest news, this is usually achieved through (APIs) or application programming interfaces, smart contracts, or blockchain services.

Autonomous Finance

This refers to the delivery of personalized, automated financial services working via artificial intelligence (AI). The most suitable term used to describe this technology is “self-driving money.” To put it simply, the innovation offers an app to create and perform a financial plan based on an individual’s goals, age, risk tolerance, balances, and other factors. These apps work like an intelligent digital financial advisor to control your money 24/7.

P2P payment

Also known as peer-to-peer payments, refer to another growing area in the FinTech app development sector. They are used to eliminate the need for third-party websites to ensure easy fund transfers among accounts.

Experts believe that is a promising space for investments, as there are many services to make P2P payments even more efficient and secure using biometrics, facial recognition tech, and much more innovations.

Blockchain

The last but not the least option for your startup to gain revenue and popularity is to develop a blockchain application. This is a fresh, promising idea that is ready to sweep the markets in the upcoming years. Depending on your choice, you can make various blockchain development products that will sell tokens or offer a platform for traders with the same demand.

Why consider building a fintech app?

Since every day, more and more people from different countries are starting to use customized FinTech applications and benefit from all their opportunities; it seems they can quickly take the world by storm. Adapting the newest technologies like IoT, AI (Artificial Intelligence), and data science, such products are going to provide an amazing user experience. Now this industry has a multi-million dollar revenue and has received new meaning from apps such as Apple Pay and Alipay.

According to Eeescorporation.com, digital wealth organizations are suggested to have $600 billion in assets under management. Experts believe that in 2022, the most promising trends will be digital banking, white-label fintech, data aggregation, blockchain, robotic process automation, voice-enabled payments, and big data.

As we see, the industry is in high demand and gains popularity every day. So brands looking for ideas to enter the space to gain revenue and provide people with the latest tech advancements can safely turn to such trends and enjoy all the benefits provided by this ecosystem for both sides.

Learn about our experience

We, at Interexy, have deep expertise in over 15 spheres, including the FinTech ecosystem. Our team consists of driven minds, and we always ensure the most dedicated selection process for each project, delivering only unmatched quality products that gain popularity and attract numerous customers.

Our developers use only the latest technology advertisements, applying IoT, AI & ML solutions, Blockchain, and a lot more to provide clients with satisfaction and overcome all industry’s expectations. Producing custom apps, we are strong believers in originality, so our onboarding process is well-thought-out, allowing us to gather all minor requirements to make the best of the best apps based on personal needs and business goals.

Let’s discuss your concept and enter this fast-speed ecosystem with our experts!

Conclusion

In this article, we have covered the most vital information regarding FinTech while also admitting potential risks and the most exciting ideas in this world. This is only the surface of what this industry offers, but if you are a startup, middle company, or a large enterprise looking for brand-new ways of gaining more revenue – consider building these apps is your best idea. And if you’re interested in more details of the development process, we are here to explain the ins and outs.

FAQs

How much money can you make in fintech?

The answer will depend on what app you developed and on several other factors, including the complexity of the product, the number of features, the location of the target audience, and more. However, there is a rough answer for this question, as statistics show that the average cost is $125,000 per year or $64.10 per hour.

How do FinTech apps make money?

There are numerous ways of gaining money through this technology. One of the most prominent today is peer-to-peer lending, where people borrow money directly from others, eliminating the middleman and financial organizations. This provides an opportunity to earn interest in the money they lend to others working through this model. By offering such connections, software companies make significant fees.

What are examples of fintech?

In today’s world, you can see a lot of examples of such solutions. However, the brightest ones are digital lending, credit, mobile banking, mobile payments, cryptocurrency and Blockchain products, insurance, trading, and much more.