June 18, 2022

How To Make An Effective Personal Finance Application: Cost & Features

Table of content

- 1. How To Make An Effective Personal Finance Application: Cost & Features

- 2. What is a Personal Finance Management App?

- 3. How Do Personal Finance Management Apps Make Money?

- 4. Types of Personal Finance Apps

- 5. Benefits of Personal Finance Management App

- 6. Must-Have Features Of A Money Management App in 2022

- 7. How to Develop a Personal Finance Management App

- 8. How Can Interexy Help?

- 9. Final Take

- 10. FAQs

Let’s be honest; modern people don’t want to manage their money by collecting piles of receipts. However, it is vital for them to have a convenient place where they can check their expenses and track them. Therefore, there is an urgent need for a personal finance app that will allow people to have easy access to their money and help them better manage finance questions on the go.

In order to not to be fabulous, let’s see the latest statistics. According to the source, approximately 63% of smartphone users have at least one personal finance app today. In addition, around 2/3 of US residents’ smartphone users use a personal finance app to manage their finances. Statista also reported that the total transaction value in the personal finance industry is expected to reach US$10,128 million by the end of 2022.

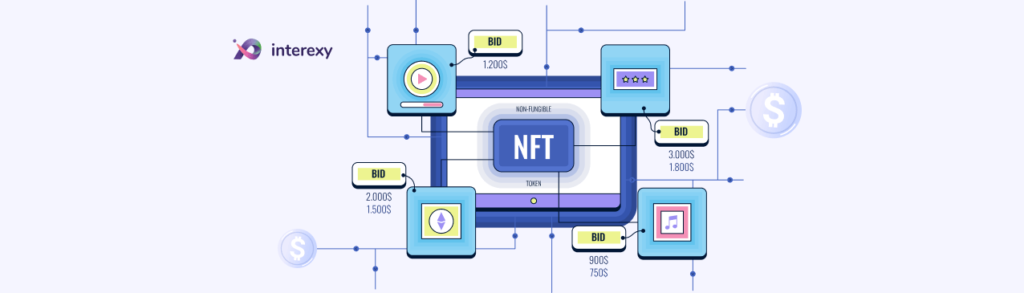

The rise of popularity in the niche has happened due to COVID-19 restrictions as well as the boom of NFT and cryptocurrencies during the last few years. Now people are more aware of their finances and want to easily manage them regardless of their location. As a result, businesses have started to invest in personal finance management app development to attract users and make a profit from this flourishing domain.

Since these applications provide substantial value to customers and are high in demand, developing this product can be a good investment. Let’s discover how to build a personal finance app while also learning the benefits, features, and budget for this kind of app with our guide below!

What is a Personal Finance Management App?

As the name implies, a personal finance management application is a mobile software tool that allows users to manage finances better. It contains the financial information of a user and device this data to provide insights for better financial management and planning. These applications can take various financial data as input information and allow users to manage money through bank records management, budget management, investment tracking, portfolio, and more.

Talking generally, a regular personal finance management app is used for the following purposes:

- Managing money by tracking income and expenses;

- Planning a budget as well as tracking savings;

- Making payments;

- Getting money through savings and investments;

- Checking credit score.

How Do Personal Finance Management Apps Make Money?

In-app Purchases

As you can understand, you can provide your users with an opportunity to buy services, features, and products directly from your app. This will allow you to make a profit. However, it is not a vastly used way to monetize your application since not every app can offer products and services for many reasons.

In-app Ads

If your app is in demand and used by many people, then this option is great for you. This is because businesses love to place ads in various applications to get traffic and customers. And you will also have a chance to easily monetize your app. Since most people are getting annoyed by ads, you can provide a paid version without ads, also getting income from this option.

Subscription

This is one of the easiest and most appealing ways to monetize personal finance apps. This is because there will be no annoying ads or purchases. You don’t need to set a high price from the start, just allow users to update the premium version of the app with an extra price later to make a profit.

Types of Personal Finance Apps

Even though there are many types of personal finance apps, let’s explore the most common today:

Habit Trackers

As the name suggests, these apps help people monitor their spending habits and improve them. They help users to reach financial stability through simple steps.

Budget Planners

Budget-focused applications allow users to plant their money for the following weeks or months to determine monthly spending with the aim of achieving financial goals that they set for themselves.

Basic Money Management Apps with Manual Data Entry

Since it is a common practice that some features may crash in applications within time, the opportunity to manually add information to a personal money management app is in high demand.

Full-Service Banking App

A full-service banking app is almost all-in-one-place, allowing customers to use various versions of the app simultaneously. Therefore, some banking apps work like habit trackers while also providing other features related to different app types.

Benefits of Personal Finance Management App

Efficiently Organize Finances & Budget

Personal finance applications help people easily keep track of how much money they have spent on various purchases, analyzing expenses & incomes, which, in turn, helps in making smart decisions on budget planning.

Securely Manage Finance

These applications provide people with peace of mind, as everyone wants to know the expenses and budget that they have for upcoming days and weeks. It is also valuable in distributing money and achieving a better balance between must-buys and occasional luxuries. At the same time, they can keep the money as savings.

Helps Make Sound Financial Decisions

Another vital benefit of money management applications is that they prevent impulsive purchases. Since apps help create a proper monthly budget and fund distributions, the risk of wasting money is reduced. Therefore, people will make better decisions about their spending.

Must-Have Features Of A Money Management App in 2022

Easy Registration

Any type of money management app requires data from the user to efficiently organize work. However, you need to make registration easy and quick not to ruin the user experience. Here is the information you will need to collect from the user:

- email and password

- bank account credentials

- basic demographic information

Simplify the registration stage, providing options to sign in via Facebook and Google.

Performing Transactions from Banks

No one wants to input data manually before using an app. Luckily, no one has to do it now. Connect your application with users’ bank accounts through secure APIs, e.g., Plaid, that then will automatically fetch all transactions from banks. And in case of user-pay cash, provide several options for quick and easy data entry:

- voice input

- home screen widget

- image recognition for receipt scanning

Categorization of Expenses

Whenever a transaction happens, the app should divide expenses into several categories. This helps users to know exactly what they are spending their money on, and this is an essential feature of the app.

Provide them with category templates and allow them to customize buttons if they want to. It is also advised to add AI and machine learning into the app, making it easier for apps to recognize typical expenses and categorize them accordingly.

Budget Planning

Your finance app should provide a convenient budgeting option for users to plan their spending. It is recommended to allow people to set a budget for a week, month, two weeks, and a month. You should also allow them to start and end dates for all budgeting periods.

Setting a Finance Goal

Financial goals allow users to better manage their money and have the motivation to save money or manage a budget. Allow people to create custom goals with engaging design to help visualize something they want to achieve and boost their interest in it. You can also integrate your app with specific marketplace APIs like Amazon’s Selling Partner API so users will always see their goal and have a quick link to it.

Push Notifications

Finally, push notifications are the easiest way to keep your users engaged and informed about news, updates, transactions, and more. This boosts users’ interest and makes sure they always know when something happens with their money.

Learn how to create a FinTech app that will make a profit.

How to Develop a Personal Finance Management App

1. Identify Your Target Audience

Even though a finance app can cover lots of people, we recommend you focus on a younger target audience. This is because young people between 18-35 ages are more likely to use such applications and as well as pay for them when buying. When you know your target audience, it will be easier for you to cater to users’ needs and gain attention in a competitive market. Here is what you need to learn at this stage:

- Where are they located?

- How old are they?

- Do they have goals?

- Do they have kids?

- What mobile platforms do they use?

- Where do they live?

2. Perform Research on Competitors

This stage is essential if you want to get a high-quality product and do not waste time on unnecessary elements. Market research involves analyzing competitors, their apps, what people like and what they don’t like, why apps do not succeed, and what successful apps do to achieve results.

3. App Designing & Development

Only when you learn the audience’s needs and perform research should you start the design and development. However, it is vital to follow steps during the development that include:

- Create wireframes

A wireframe represents a blueprint showing what the final app is going to look like. It doesn’t need to contain color or graphics but should have essential elements such as headers, navigation buttons, and more.

- Create mockups

A mockup refers to a prototype of the final product. It should show how the finished product will look without functionality.

- UI/UX Design

This stage is essential, and you need to hire experienced designers who have already worked in this niche. An engaging yet simple interface will attract users and always increase the number of downloads.

- Development

If you know your target audience and know what platform they use, you need to choose a tech stack according to the results of the research. It is best to hire a highly-skilled development team to help you choose technologies and the rest of the questions that will appear.

4. Testing

The development is ready; congratulations! Now you need a QA team that will accurately test your product to avoid bugs and ensure a successful launch. Your team will need to use a combination of manual and automated testing to simulate real-life scenarios and guarantee the app is stable and efficient.

5. App Marketing

Do not forget about marketing your app after launch, as it will affect how many users you will get and whether you will overcome competitors or not. Hire a professional marketer that will organize all campaigns.

Personal Finance App Development Cost

The price hugely depends on many factors, including the complexity of the app, chosen team, tech stack, location of the team, and more. But let’s compare the average price divided by different types of options:

| Type | Average cost in $ |

| In-house team | 150,000 |

| The US-based development company | 100,000 |

| Freelancers | 50,000 – 200,000 |

| Outsource development agency | 90,000 |

How Can Interexy Help?

Interexy is a well-known app and web development company that has huge expertise in over 15 industries. As a leader in the Fintech industry, we provide in-depth expertise and top-notch Fintech app development services. Alongside regular development, we offer AI, ML, and blockchain development that can boost any personal finance application and make a high profit.

We provide only unique and specialized resources for every client, which can boost the entire development process and make sure the app is compliant with strict guidelines. Our process is smooth and clear with no hidden fees, allowing clients to always stay informed and updated at every given moment.

Final Take

Whether you wonder how to make a budgeting app or just want to explore cost and features, this guide is the way to go. We collected the latest information about personal finance app development, so now you can grab your trusted development team and start the process tomorrow to get a competitive advantage. Let’s book a free call to discuss your idea in detail!

FAQs

What is a personal finance management app?

A personal finance management app is software that allows people to manage their money.

How to make a budgeting app?

Start with market research, learning about your audience, creating mockups and prototypes, and finish with design, development, testing, and marketing.

What are the most common mistakes startups make when they start a finance app?

Most common mistakes include skipping MVP development, hiring freelancers, and not learning about the industry’s legal regulations.