September 23, 2022

What is Cross-chain DEX and Its Working Mechanism

Table of content

Decentralized exchanges, more known as DEXs, refer to peer-to-peer marketplaces where crypto traders can make transactions directly without handing over the management of their funds to an intermediate party. All transactions that are facilitated through DEXs happen using self-executing agreements written in code, known as smart contracts.

DEXs have become increasingly popular during the last few years with the rise of cryptocurrency uses. The market size of decentralized exchanges is estimated to reach USD 507.92 billion in 2028, according to experts. From the early days of Bitcoin, exchanges have started to play a crucial role in matching cryptocurrency buyers with sellers. Without exchanges that attract users from all over the world, the market would have much poorer liquidity and no way to agree on the correct price of assets.

Years ago, centralized players dominated this field. However, with the rapid growth of technologies and uses of cryptocurrencies, as well as new industries applying crypto, a growing number of tools for decentralized trades have been invented. This article will take a dive into what is a decentralized exchange and explain how DEX works.

What is Cross-chain DEX (Decentralized Exchange)?

Decentralized exchanges rework by using smart contracts that allow traders to execute orders without an intermediary. In contrast, transactions happening on centralized exchanges are managed by a centralized organization like a bank or any financial organization involved in services aiming to make a profit.

As we mentioned, centralized exchanges create the majority of the trading volume in the cryptocurrency market since they are regulated and provide users with easy-to-use platforms for newcomers. To be more specific, there are also centralized exchanges that offer insurance on deposited assets.

The services that a centralized exchange offers can be compared to those provided by a bank. Banks keep funds of their clients, making sure money is safe and providing security and surveillance services that individuals cannot deliver independently, which also boosts the turnover of the funds.

On the other hand, decentralized exchanges are focused on giving users an opportunity to trade directly from their wallets by using written smart contracts behind the trading platform. Therefore, with decentralized exchanges, traders protect their funds and are responsible for losing them in case of a mistake or poor protection, like losing their private keys.

In addition, decentralized exchanges have higher safety than banks since they are developed on top of leading blockchains that support smart contracts. Since they are developed on top of layer-one protocols, DEXs are built directly on the blockchain. Ethereum has long been the first choice for DEX’s development.

How do DEXs work?

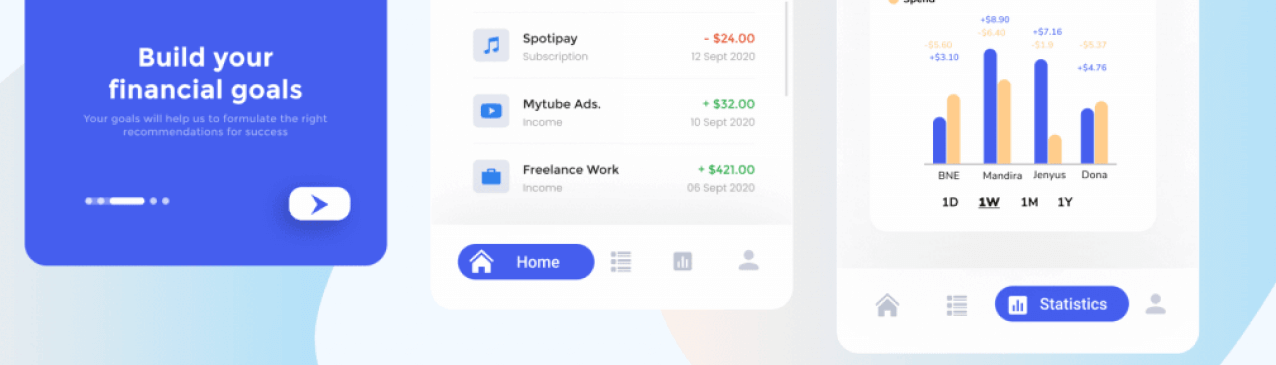

Registration into a conventional cryptocurrency exchange starts by creating an account. Once users have deposited funds or connected their existing crypto wallet, they will be able to buy, sell, and trade cryptocurrencies, creating a quick transaction or building a long-term portfolio.

Now let’s explore how do decentralized exchanges work. Decentralized crypto exchanges connect cryptocurrency wallets to software running on the DEX website. The app will tell you the price and if you approve it, a transaction can happen. With these exchanges, users do not need to log in, provide a name or email address, or even create an account. This is one of the key differences between centralized vs decentralized exchanges.

It is worth noting that DEXs won’t match you up with an individual seller. In contrast, they employ automated market makers, known as AMMs, to provide users coins and tokens from a liquidity pool: which is a quantity of currency that other traders have made available for a limited period. Therefore, when users buy an asset at a decentralized exchange, they buy from a liquidity pool.

The AMM method allows users to join liquidity pools by lending funds to them. They can make their funds available for a few days, weeks, months or another specified period. And they get funds back combined with a portion of the transaction fees generated by the liquidity pool by the end of the period.

Related: Explore how to build a crypto exchange platform with steps and cost.

How Does Cross-chain Interaction Work

The cross-chain protocol facilitates interoperability between blockchains and allows for the exchange of data between blockchain networks. Using the cross-chain protocol, users are able to communicate freely without the involvement of intermediaries. Cross-chain technology works through the following several main features:

- Principle of atomicity;

- Proper consistency between several interconnected blockchains;

- Allows the distribution of networks across various platforms.

The importance of cross-chain protocol lies in the fact that it allows users to share data and trade tokens without any intermediary. This technology has become increasingly popular in the modern tech world. The cross-chain infrastructure facilitates blockchain interoperability, allowing two or several blockchain networks to increase their efficiencies, trade-off decentralization, and security.

However, there is no accurate work mechanism for cross-chain technology since no defined approach can be applied to all networks. Therefore, every network uses a different system on blockchain interoperability to allow transactions without using third-party integrations. Below you will see the most common and widely known approaches:

Atomic Swaps

Atomic swaps represent exchange facilitators that allow two different parties to trade their tokens on different blockchains. This type of working mechanism does not involve a centralized third party to facilitate the transactions. Therefore, it allows users to directly trade their tokens on a peer-to-peer basis.

Relays

Relays allow blockchain networks to keep a check on the trades and events that take place on other chains. As a result, relays work on a chain-to-chain basis without the distributed nodes facilitating a single contract that acts as a central client of other nodes. This mechanism allows it to verify the entire history of transactions and specific central headers based on demand. The relay method needs a lot of expenditure to operate and take care of the security of transactions.

Benefits of Cross-chain DEX

Facilitates Truly Decentralized Crypto Trading

Cross-chain DEX mechanism provides a seamless way of exchanging digital assets without the need for third-party governance. This is the key benefit of DEXs. Due to atomic swaps, users can now quickly exchange tokens between several blockchains without interoperability issues.

Lower Trading Risk

Atomic swaps offer traders complete control of their cryptocurrencies. Therefore, holders are the ones who have private keys getting full control over their digital assets. This has been shown to significantly lower the risk that comes with centralized exchanges.

Simplifies Crypto Trading

Cross chain DEX protocol simplifies the trading, making it understandable and convenient for newcomers. That is because it allows token holders to store all their digital assets in a common wallet instead of one wallet for each blockchain network.

Anonymity

As we mentioned, DEXs do not involve registration, email or other user data, keeping traders anonymous. Since the NFT and crypto world doesn’t like identification at all for some reason, DEXs attract more and more users who do not want to identify themselves.

Preservation of Assets

When a traditional exchange shuts down, authorities are able to confiscate all servers and assets, including users’ accounts. In contrast, a decentralized exchange server is a network of computers scattered all over the world, so it is almost impossible to restrict its operation.

Reliable

Centralized exchanges are well-known for their extra layer of security and reliability when we talk about transactions and trading. Since they make transactions through a developed, centralized platform, DEX offers higher levels of comfort.

Leverage

One of the key reasons why traders like DEX is that they offer an option to leverage their investments using borrowed money from the exchange, which is known as margin trading. This allows traders to reap higher returns, though losses can also be amplified.

See Our NFT & Blockchain Development Process

Download this file to see how we helped our NFT clients, how we can lead you to success and what process we use to achieve this

Disadvantages of Using DEXs

Speed of Transactions

Processing transactions on DEXs can be slow. This is because of the mechanism of operation. First of all, calls must be sent to the network and confirmed by miners before they will be ultimately processed. Therefore, DEXs are known for the lower speed of transactions thanks to changes in the value of the crypto exchanged, which results in “price shifts.”

Vulnerabilities in Smart Contracts

Smart contracts written on blockchain like Ethereum are publicly available, meaning every interested party can easily review the code. However, smart contracts that are located on large, decentralized exchanges are audited by reputable organizations that help ensure code security. Choosing an experienced development team that has expertise in blockchain application development services can reduce this issue.

Liquidity Issues

Good liquidity can be achieved by centralized exchanges through a large amount of capital. However, DEX often has an issue in this regard since its liquidity depends mostly on the number of users that trade on the platform in contrast to centralized exchanges. This issue seems to be resolved in the upcoming years.

Top 4 Decentralized Exchanges (DEX) for 2023

Let’s explore what are the best decentralized exchanges below:

1. Gemini – For Nifty Gateway Users

Gemini is an excellent DEX for those who want to get started with crypto trading. This exchange delivers an easy-to-use and versatile interface for beginners and experienced traders. Being compliant with SOC 1 Type 2 and SOC 2 Type 2, Gemini is a secure platform working through hardware security keys for extra security.

2. FTX – For More Experienced Traders

FTX is a great option for non-US residents looking for a cryptocurrency exchange that supports other fiat currencies like Euros or pounds. However, FTX is also available solely for the US, a subsidiary that deals exclusively in USD. FTX is a more advanced exchange for more experienced users that was established by traders who wanted to develop a platform for newcomers users and professional trading firms.

3 KuCoin – Best For Non-US Residents

KuCoin isn’t licensed to work in the United States. However, this exchange is a beloved option for many traders thanks to excellent advanced features along with attractively low fees. Non-US residents will greatly benefit from KuCoin since the platform offers a wide range of coins for trading and a solid user base.

4. Kraken – Best For Margin Traders

Another popular trading that has gained attention is Kraken. The platform features more than 80 cryptocurrencies and a diverse selection of user options. It’s a fully functioning DEX exchange, meaning new traders will have a steep learning curve in case it is their first time working with cryptocurrency exchange platforms. As a result, Kraken is mostly used by retail and institutional investors, while margin and futures trading is also available.

How Can We Help?

Interexy is a well-known blockchain development provider. Being on the list of Top Dubai & Miami Blockchain Development Companies, we offer in-depth expertise in smart contract development services. Working with the latest technologies and having a team of highly-skilled engineers, we can cover the development of all apps and platforms that work on blockchain, including DEX development.

We pride ourselves on offering clients a team with relevant experience and unique skills that can deliver above-industry quality products. Whether you have just come up with an idea, have a concept for a project or are looking for team augmentation services to fill the skill gap in the team, book a free call with our experts to discuss questions!

Final Thoughts

Even though some believe that the importance and uses of cryptocurrency slows down, the industry is only in its early stages of development. Being rules-free and giving users full control over their tokens make the space highly attractive. Therefore, the DEX market keeps evolving, bringing transparency, convenience, ease of use and higher safety. Even though the cross-chain mechanism is not a fully-developed technology yet, experts believe that all trades will be performed between the two owners of funds in the near future. And the cross-chain protocol will play a great role in such interaction since more and more blockchain platforms seem to emerge soon.

FAQs

What is DEX (Decentralized Exchange)?

A decentralized exchange (DEX, for short) represents a peer-to-peer marketplace where users can trade cryptocurrencies in a non-custodial manner without an intermediary involved to facilitate the transactions.

How Does DEX Work?

DEX fulfills one of crypto’s core possibilities: providing financial transactions that aren’t managed by banks, payment processors and any other type of intermediary. DEX works using smart contracts.

What are the benefits of DEX?

There are many benefits of DEX, including higher transparency, safety, ease of use, reliability and provide opportunities for investors.