November 16, 2022

What is Real Estate Tokenization | Guide, Definition, Pros, and Limitations

Table of content

Real estate has always been considered a profitable and relatively safe investment. Regardless of what happens in the world and in the stock market, people will always need places to live and work. Even though the real estate market experienced growth, the transactions in this field are also complex and expensive, rendering real estate relatively illiquid.

Since people still want to invest in real estate, the space has seen some improvements in making real-property interests easier to deal in. But some new methods that appeared during this year seem to go further in transforming the purchase, holding, and sale of real property. It is called tokenization.

Although we will dive deeper into the definition below, tokenization means representing ownership of an asset in real estate using virtual tokens that are placed on a blockchain ledger. Since tokenization happens with blockchain help, it offers a vast range of benefits and opportunities for investors and owners that overcome traditional methods of dealing in real estate. Some benefits include higher security, easier transactions, and increased liquidity.

Tokenization has just started and needs more time to establish on the market as a go-to method for real estate. It is still a complex process requiring legal and technical knowledge. We created this article to explore the real estate tokenization process, how it works, benefits, and limitations you should consider before launching a real-estate-backed virtual token.

What is the Tokenization of Real Estate?

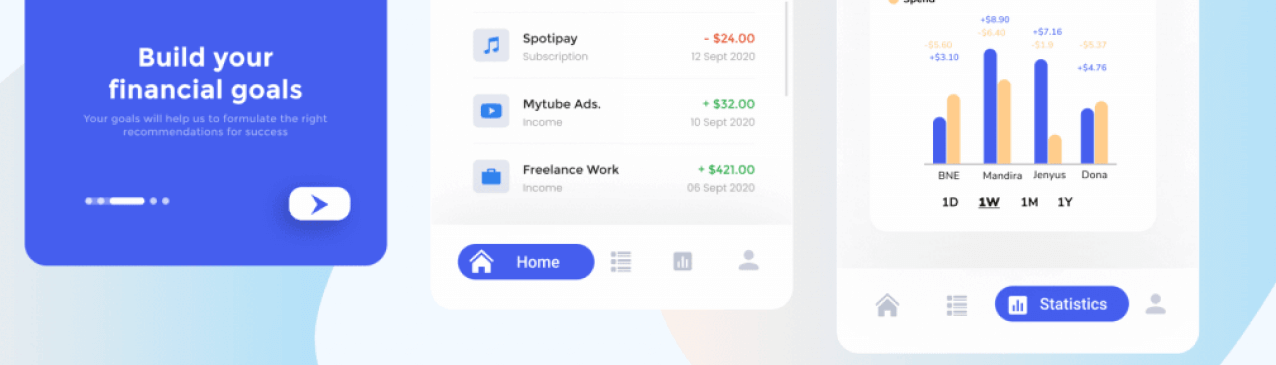

The report shows that the global real estate tokenization market is suggested to grow from $1.92 billion in 2021 to $2.32 billion in 2022 at a compound annual growth rate of 21.09%.

Even though tokenization is a relatively new term, it has already become a buzzword in some communities. The term describes a cryptocurrency fundraiser in which investors exchange fiat or crypto assets for “real estate tokens.” Simply put, real estate tokenization is an excellent way to securitize real assets.

Securing an asset means dividing it into shares that can be sold to investors. The same means tokenization of an asset – divide it into shares, or “tokens,” representing a predefined share of the real estate asset. They can also sometimes be called “security tokens.” The securing process realizes through the immutability of the blockchain ledger, and they can be traded using crypto exchanges or Alternative Trading Systems (ATS).

How does Real Estate Tokenization Work?

Real estate tokenization development helps overcome challenges that traditional real estate faces. This is done through 5 following stages:

1. Structuring the Deal for Smart Contracts

The shareholder type and legal regulations are essential in real estate tokenization projects. When you want to start real estate tokenization, parties need to lay and follow ground rules for current and future investors beforehand.

2. Asset Digitalization

The data relating to real estate deals are stored on the blockchain ledger through smart contracts and security tokens that are then issued. To securitize a real estate asset and get a profit from it, parties need:

- Single asset Special Purpose Vehicle Structure- SPV is designed to allow accredited investors to take part in the deal. This structure involves tokens representing the shares of the real estate property.

- Real estate fund Structure – This is an act that works like a private equity fund where an asset represents units of this fund.

- Finance Structure – Tokenizing real estate in this structure allows for fundraising in an efficient way. Then these assets can be sold to investors or qualified institutional buyers in the third-party market.

Depending on these structures, parties can write smart contracts and lay ground rules to be followed.

3. Tech Selection

Like any project, choosing the right tech stack is essential for real estate tokenization. Once you found your real estate tokenization provider, you have to make 3 important decisions:

- Blockchain and token selection: The team and you will need to identify the right blockchain. Choosing the blockchain ledger involves checking gas fees, speed, transparency, reviews, and security.

- KYC/AML verification: Those buying tokens and investors alike will need to complete KYC/AML on the platform.

- Primary or Secondary Marketplace: You need to choose what marketplace you are going to sell your assets.

4. Token Distribution

Once your development team has written smart contracts, the next step is token creation and distribution. Real estate tokenization platforms provide various payment methods to buy assets. There are two key methods for token distribution:

Primary Distribution: This method means the distribution of minted tokens to the investors in return for their initial capital investment in the real estate tokenization projects.

Secondary Trading: This method involves listing assets on other exchanges where all investors can exchange the assets with other tokens or users.

5. Post-Tokenization Support

The last yet vital stage of the entire tokenization process is post-support. This usually involves mortgage challenges, dealing with legal issues, activity tracking, liquidity tracking, and more.

Benefits of Real Estate Tokenization

1. Higher Transparency

As we mentioned, real estate tokenization is known for higher transparency. Since this process uses blockchain to store information and smart contracts to execute transactions, data programmed into a digital token is very secure, while smart contract conditions are open for any interested party to see.

2. Better Liquidity

Even though real estate has always been an attractive investment, it was always considered a low-liquidity option. That is because there is a great capital requirement, so lots of paperwork and multiple parties are always involved, increasing the number of private players. Tokenizing real estate comes into the picture, allowing investors to enter easily and boosting overall liquidity.

3. Easier to Manage Properties

One of the obvious benefits of real estate tokens is that it is easier to manage properties in contracts with traditional real estate. The key challenge reported by property owners is delayed monthly rent payments. This can quickly be changed with tokenization thanks to blockchain-based smart contracts or tokens, which allow you to register documents into a special database.

4. Proof of Ownership

Ownership rights have long been the reason for so many intense legal battles in the real estate industry. They not only cause legal difficulties but can also affect the brand’s value, which takes lots of money and time.

Tokenization means data is stored in the blockchain, so no one will be able to tamper with it. Clear and declared fractional ownership allows owners to start evaluating transactions from the past or the present.

Limitations of Real Estate Tokenization

1. Securities Law Implications

Real estate tokenization seems to be considered security but an analysis of each specific token has to be considered at the outset. In case the token is a security, the issuance of the token will have to be applicable to prospectus requirements or reliance on an exemption, including the “accredited investor” exemption. Besides the prospectus requirements, the issuer may also consider the applicable registration guidelines.

2. Reconciliation with the Land Registries

Real estate tokenization also needs to follow the current systems of land registration. Since each jurisdiction provides its own land registration system, a real estate token issuer will need to reconcile the transaction following the land registration systems rules of the jurisdictions where the underlying real estate is based.

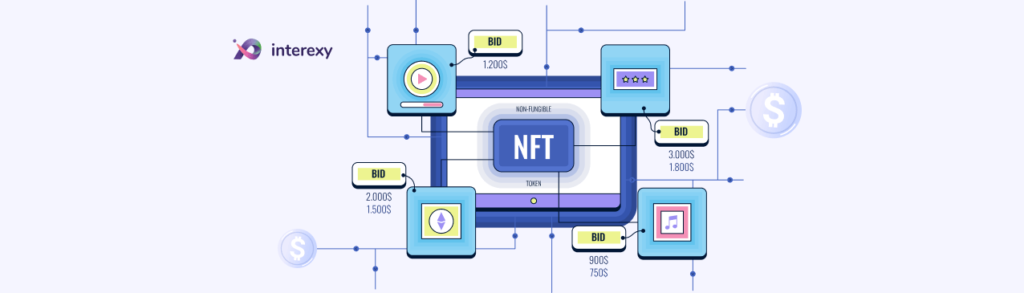

Security Token Offerings (STO) vs. Non-Fungible Tokens (NFT)

If you are reading this article, you probably know words like NFT and STO. However, not everyone knows the differences between them and what is best for real estate investment tokenization. Let’s explore this question.

STOs is a short name for “security token offerings,” which involve an offering of digitized securities, including stocks, bonds, as well as other tokens. NFTs are short for Non-fungible tokens (NFTs’) that represent pieces of a digital asset stored on the blockchain. NFTs are unique and non-fungible in nature, which means they cannot be exchanged for one another.

Tokenization in real estate usually uses security token offerings (STOs), which are explicitly securities following the U.S. Securities and Exchange Commission (SEC). However, security token offerings refer to fungible tokens, which means that one STO for a specific real estate property works just like any other for that asset.

The Future of Real Estate Tokenization

Tokenization is just in its very beginning, yet experts predict a bright and promising future for that field. That is because the process offers a convenient and economical way of investing in the real estate industry. Since this space is a relatively new investment vehicle, more time is needed for regulations to be established in a consistent framework of rules.

Besides being an excellent and safer investment option, asset tokenization real estate seems to have the potential to transform real estate investment by boosting liquidity in a largely illiquid asset class, lowering risks and barriers to entry for investors, and greatly reducing transaction costs. However, issues like clear market regulation, marketing the space, and the need for centralized reporting of transactions are key issues for the market to grow.

How Can We Help?

Being the top Dubai & Miami blockchain application development company, Interexy is also one of the leading developers in the field of NFT development services and Metaverse. Since we are experts in all these spaces, we always check the latest trends in the industry and use technologies to power businesses worldwide.

We have already entered the real estate tokenization space and are ready to offer clients a trusted process to start tokenization. Our Real Estate Tokenization Development Services have been tested and reviewed to make sure we provide the best possible processes throughout the tokenization.

Book a Free Call!

Learn more about our expertise and get a detailed approach and solution for your specific case

Book a callFinal Thoughts

Asset tokenization real estate is a popular term, especially in the field of NFT and metaverse today. Being a relatively safe investment option with high liquidity, this domain seems to grow dramatically over the next few years. Some companies have already considered starting the tokenization process. If you are looking for more details or want to tokenize your real estate, book a call with our experts!

FAQs

What is real estate tokenization?

Real estate tokenization is when real estate becomes a real property with a blockchain-based fractionalized ownership structure.

How does real estate tokenization work?

Real estate tokenization converts real estate into a token that is stored on a blockchain, having digital ownership and transfer. These digital tokens represent a fractional share of an ownership stake in that real estate.