June 10, 2022

A Full Overview On How to Create a Mobile Banking App

Table of content

In the 21st century, the digital era is only growing, and smartphones have become a must-have tool that eases most of the daily processes. Due to the increased number of technologies, phones have become much more efficient, secure, and in demand. Now people use them for various purposes, like ordering food, grabbing a taxi, or managing their finances. As a result, all businesses also utilize the benefits of digitality and provide their own application to grow the customer base and go along with worldwide digitalization.

The banking industry is one of those lucky ones that have been able to reap the benefits of people’s need for smart solutions. Since banks have always been a time-consuming and boring place, they had to enter the mobile space to stay in demand, especially after the COVID-19 breakdown. As a result, the use of mobile banking is suggested to grow steadily between 2020 and 2024, where the Asian market remains the largest sector, according to Statista. The Far East and China have over 800 million active online banking users. And the number is expected to reach nearly one billion by the end of 2024.

The number of mobile banking users in the US is expected to grow year on year between 2021 and 2025. In 2021 there were only 197 million users, while experts predict the number will grow to 217 million by 2025. Now it can be clearly seen that mobile banking has become increasingly widespread and doesn’t seem to stop. Based on a recent survey conducted in the US regarding mobile banking usage in February 2020, the most valuable features used in these apps were mobile check deposits, statements, and account balances views.

However, in 2022 people want more efficient and quick solutions. This is why we curated this guide to help you learn how to build a mobile banking app that will attract modern consumers and bring you revenue.

What is a Mobile Banking App?

We’ve just seen lots of statistics and great facts about this industry. But what does a mobile banking app mean? Let’s explore below.

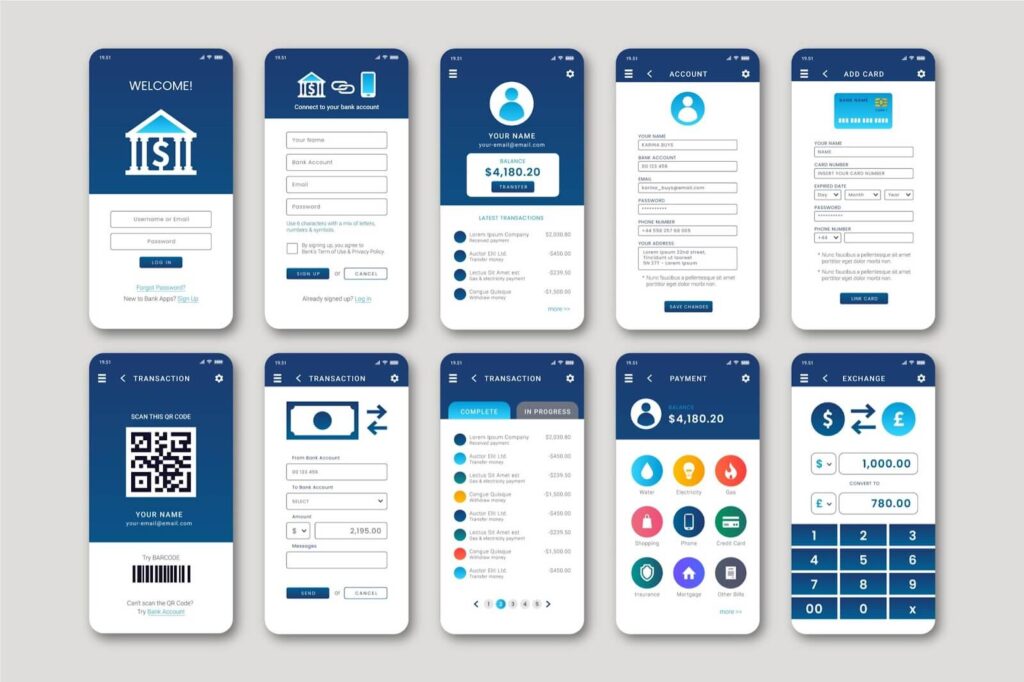

Mobile banking is software available on mobile phones that represents a compressed version of all banking services in one place. Mobile banking apps are available for both Android and iOS platforms and can be found in relevant marketplaces (Apple Store and Google Play). Once installed, consumers can create their profiles and manage their money. In reality, most of these apps allow users to perform most services they previously did in physical banks. Here is the list of facts about mobile banking applications:

- Perform a variety of banking transactions;

- Users need a smartphone and stable internet to use this app;

- Mobile banking apps allow users to conduct banking transactions at any time and from any location;

- Users can use SMS to use mobile banking services;

- Users usually receive push notifications via the mobile banking application.

Mobile banking apps are different from Fintech applications. Learn how to create a Fintech app.

Mobile Banking Apps Trends 2021-2023

As we mentioned before, in 2020 most valuable features in such apps were check deposits, statements, and account balances views. However, more and more tech innovations entered the banking industry, and now people want to see them in mobile apps. The most efficient and trendy technologies you can use when building a banking app include the following ones:

Biometric Security

Security is one of the key factors determining whether users will love your app or avoid it at all costs. Even though modern technologies usually allow companies to craft stable and secure apps, hackers also develop new ways to steal money from users’ accounts. For example, according to the Federal Trade Commission, credit card fraud increased by 104% between 2019 and 2020.

This is where the biometric authentication trend seems to be a go-to solution for any banking app development. This technology has been specially designed to power the security of sensitive data and facilitate compliance with financial regulations. It works by recognizing faces, voices, fingerprints, and other biometric solutions to prevent any unauthorized access.

AI-Powered Chatbots

Artificial Intelligence is also highly popular in mobile app banking development today due to some valuable reasons. AI bot represents a software solution that is designed to execute special tasks according to suggested scenarios. Since developers can train AI, this chatbot can support conversation like a real human, speaking about various issues and providing advice. This allows banking and financial organizations to speed up a vast range of manual and routine operations, reducing waiting time when the client has a question.

Machine Learning (ML)

The use of machine learning, which also belongs to the category of artificial intelligence, is on the list of hottest digital banking trends in 2022. By using this technology in banking apps, companies can easily analyze user data to identify and better cover client needs. By providing relevant and efficient solutions, banks significantly improve user engagement and boost revenue.

Blockchain

Blockchain has already become mainstream for most businesses, and banks can probably benefit from this technology the most. Based on the Statista report, the number of blockchain wallets increased up to 70 million in 2021, increasing from 10.98 million at the end of 2016. Blockchain also boosts the security of sensitive user’s data and improves the whole banking process without any third party.

Challenges and Risks

Security

As we mentioned earlier, banking apps are an appealing target for hackers. The threats happen too often for many reasons, where lack of security is the main issue causing them. And with the rise of technologies also increases the number of attacks. Therefore, businesses have to always provide advanced security measures to ensure the safety and protection of users’ data. This is where blockchain, Ai, and ML can be helpful.

Regular Updates

Both smartphone and app technologies evolve on a daily basis. Thereby, developers have to regularly update their applications to keep software compatible with new operating systems and compete in the market. While it may sound easy, regular updates usually require dedicated resources, money, and time.

Transaction Approvals

To allow users successfully and easily perform transactions through their mobile banking app and make them approved, the app has to be compliant with a vast range of market requirements in terms of security and privacy. This is because other financial partners may automatically block the app in case of any vulnerabilities.

How to Build a Mobile Banking App?

Before we list the steps you need to take to learn how to create a mobile banking app, let’s explore the pre-stage required for your success. Since this stage is usually skipped by startups, they tend to fail in the real-life market where requirements are strict, and people are demanding.

Here is what you need to do during this stage:

- Identify the main problem your app is going to solve;

- Find your business model;

- Learn bank license and compliance regulations;

- What tech stack to use;

- Find the target audience.

Research and Creating Concept

By performing market research, you will get vital insights regarding your target audience, identifying its main problems you can cover, exploring competitors, and what customers like and what don’t. This will help you create a solid base for the whole development process.

Building & Testing a Prototype

The prototype is essential if you want to validate your idea before investing money and time in it. Prototype testing and feedback are helpful in learning if your app has potential. It is best to share a prototype with a test group or with your connection to listen to their feedback.

Learning Regulations

This is essential if you want to know how to build a banking app that is going to be in demand. No such app will be successfully launched without being compliant with the industry’s regulations (which are strict). This is why it is crucial to learn all regulations and requirements in advance to prevent bugs and issues later.

Designing Your App

Design plays a key role in your app’s success. This is because users will look at your app before using it, so invest money in a high-quality design team that can bring your ideas to reality without compromising quality. You can also return to stage one to identify what design is mostly used in these apps and find what to avoid when creating yours from scratch.

Choosing a Tech Stack

Market research should help you with your target audience. To be more specific, you should have learned their platforms (iOS or Android), demography, age, etc. Based on results from the first stage, you can make a decision on what platform you should focus on, thereby choosing the tech stack. You can ask your development team to help with choosing the best technologies, and don’t forget about including the trends we mentioned before.

Start Coding

Finally, you can build your application. However, it is vital to note that you should hire an experienced team with relevant background and experience in the niche. This will give you a competitive advantage and prevent wasting money on constant improvements later.

Perform Testing

Testing is vital. It helps you verify whether the app works in the way it should and how you can improve its performance before release.

Releasing and Maintaining

Once you have developed and tested your app, it is time to release the application and maintain it. Launching your app may take some time to allow the marketplace to test your app for various factors.

Marketing and Collecting Feedback

When you successfully launch your app, it is time to move further and market it. It is vital as you want to enter a highly competitive market and need to advertise your product to reach clients. You can hire a marketing team or development team to help you with this task. When you collect feedback, you will need to apply it and improve your application till clients are satisfied.

Must-Have Features of Mobile Banking App

1. Account Monitoring and Alerts

These are probably the most vital features that provide users independence from opening separate websites to check their balances, statements, and other things. To make sure your best banking application is valuable for clients even in the long run, you can also combine these features with the chance to manage to spend, create smart spending plans, investment tips, and more.

2. Multiple Factor Authentication

This is all about making your app protected and secure. Therefore, multiple-factor authentication protocols use several security layers such as passwords, one-time passwords, biometric verifications, PINs, and more that guarantee security.

3. Branch or ATM Locator

Even though this feature doesn’t exist in all banking apps, research shows it is a highly valuable addition. Modern mobile banking apps should allow users to easily find a nearby branch or ATM.

4. Customer Support

It is vital to provide your clients with customer support which can be done by both humans and AI-powered chatbots. This is because they will probably face issues when starting using your app, and if you want them to stay in the app, then you should help them resolve issues at any given time.

5. Payment Processing

Last but not least feature is payment processing. Since you want to build a banking app, it becomes obvious. This feature will make your app much more valuable if you allow it to perform transactions right in the app.

Why Choose Interexy?

Interexy is currently one of the most fast-growing app and web development companies that has in-depth expertise in mobile banking app development. We are also on the list of top Dubai and Miami blockchain development companies. Therefore, our vast expertise and knowledge can ensure your application will be packed with the latest technologies from top-notch specialists.

We work with brands who want to deliver brand-new applications to the market and gain high revenue. Our Fintech app development services allow banks to improve their regular process, reach more customers, increase revenue and provide clients with new opportunities.

Final Thoughts

Mobile banking apps are one of the most popular software products available today. This is because banks and financial organizations had to go along with tech innovations and modern consumer demands. We crafted this guide to help you learn steps on how to create a mobile banking app with features and trends. Book a free call to discuss your idea with our experts!

FAQs

How Much Does It Cost To Develop a Mobile Banking App?

The cost of the development ranges from company to company. But the price usually starts from $50.000.

How long does it take to develop a mobile banking app?

This depends on many factors. However, an average app can be built within 6-12 months.

How secure is a mobile banking app?

Depends on the security measures the app uses. But all companies now try to apply many measures to guarantee the security of the app.