January 4, 2022

Enter the Industry With a Simple and Efficient Health Insurance App

Digital solutions have entered almost all spheres of daily lives, where the healthcare industry takes the first place. With the significant impact of COVID-19, companies do not miss chances to elevate business needs and grow the client’s base. Everyone from pharmacies to hospitals and private clinics invested in various applications designed to improve the current situation.

Today, health insurance app development is one of the most popular telehealth solutions. Reaching $280 billion in 2019, the market only seems to grow. Therefore, the niche is attractive and promising to invest in. The transformation brought a significant impact into the modern world since both patients and doctors have been waiting for these changes.

Although the coronavirus will end up in upcoming years, experts believe that digital solutions will still be in demand, as they significantly ease most labor-consuming tasks previously performed by people. In addition, such products help prevent hackers’ attacks on vital individuals’ data and support business needs in several ways.

In 2021, many key players in the market felt that it would be worthy of launching apps that will connect doctors, patients, and belay providers. For instance, Oscar, a US-located organization focused on health assurance policies, became the first to introduce an app that now gained more than 520,000 users.

Moreover, other large and influential companies like UnitedHealth, Humana, Cigna, and Anthem also launched such services. They provided their numerous clients an opportunity to manage their treatment coverage with only a tap of a finger. Since people always tend to convenience and no one wants to struggle with documentation, medical assurance applications can be a life-saving option for companies providing these services.

We want you to understand the niche potential deeper, so let’s discuss the in’s and out’s below with Interexy – a highly experienced development provider.

What are the types of insurance mobile apps?

A health insurance patient app

This is the most basic and popular type that gained immense popularity in the last two years. The platform is designed for patients that want to easily access essential data related to their overall wellbeing. These products represent a digital file cabinet that collects organized patients’ medical information, such as health insurance claims processing and benefits.

Since 2019 brought a coronavirus, people have started to pay close attention to their health. They want to always be sure about any unpredictable situations and easily pay for procedures regarding the time, day, and cost. With increased awareness around wellbeing, these mobile solutions allow patients to spend less time considering challenges and allow living happier and fuller lives.

Life assurance services

The second type refers to the app that gives users a chance to easily get life protection.

By paying a desired amount of money, people can be sure their lives will be either saved or covered under challenging situations. This option is also in high demand as everyone who works in dangerous facilities, and those who struggle with chronic diseases will be happy to know they can pay doctors and have money in most challenging situations.

Car (auto) protection

Since almost 77% of US residents have a car, most consider taking a car belay. This is because cars are the most dangerous transports with approximately 4-5 accidents happening every day. With expensive repairs, no one wants to pay a bunch of money. So these apps can significantly ease repairing the car and saving money, making people feel safe and secure.

Travel belay

Although the coronavirus prevented us from traveling, those who can still travel prefer to purchase belay. This is mainly because in many countries, healthcare is expensive, and not everyone can be prepared for these high costs. So these apps are specially crafted to prevent users from paying too much and feeling safe when traveling.

Health insurance mobile app models

For patients

The option is mostly used by people now and has been shown great potential. Following rough guidelines, these applications usually have the following features:

- EHR/EMR systems

These are digital solutions containing all medical records providing patients view their history, checking the prescription medications advised by the healthcare provider, staying updated regarding test results, and more. This allows users to feel confident in their wellbeing and see a clear picture of what they are paying for.

- List of doctors

The feature helps patients get through a list of available doctors and choose depending on their disease, hospital proximity, expertise, price, insurance coverage, and wellness goals.

- Insurance claims data

Since the app provides users with an all-in-one dashboard covering belay claims, they can feel safe knowing transparent and accurate information plus scam prevention.

- Notifications

This is an essential feature helping people stay updated and informed regarding further appointments, payments, or treatment plans.

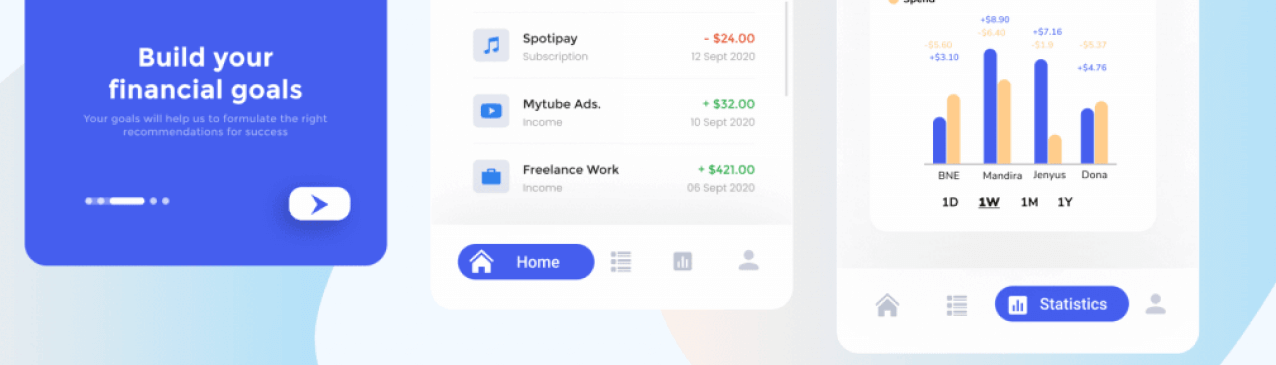

- In-app payments

These platforms are specially crafted to allow users to enjoy their assurance and check health in the most hassle-free way. So making in-app payments would also be a critical feature for your insurance mobile app development.

For healthcare providers

The development of the app enables medical providers to securely draw vital data from a single source while also ensuring only valid documents. Additionally, these platforms implement brand-new technologies to make them a significant part of the medical sector digitization and improve the hectic routine related to the handling of insurance issues.

For the processes inside companies

Even though the industry has long been here, the new tech integrations force companies to provide assurance to stay flexible and guarantee that users’ needs are satisfied and they can always get the required help.

How are these apps monetized?

Freemium

The Freemium model allows users to download and use the app for free, but if they want to upgrade it and get all features, they will need to pay extra. To monetize this model, companies take advertisers and physicians who want to appear on the platform.

Licensing

With the business model, users have to purchase the app from the very start. Alongside money from buying, the app will be monetized through insurance plan promotion or selling drugs through the app.

Advertising

Although this model is believed to bring great revenue from advertisers, it is vital to ensure your ads comply with strict guidelines since the healthcare industry is tricky.

Benefits of health insurance software development

For Patients

Straightforward Navigation

With lots of parameters of psychics experience, rating, reviews, and policies, users always struggle with finding the perfect fit for their situation. Modern apps may easily solve the issue, providing hassle-free and simple navigation across the app via numerous filters for their ultimate convenience.

Less Paperwork

By implementing the latest tech advancements, apps allow users to manage all documentation in an electronic version with no printing claims records. Therefore, all data is stored within the app and is freely available to users at any time of the day.

Reduced Costs

Using innovative search and seeing all available assurance options, users may find what suits them the best. Without all information within the app, they’ll likely overpay due to a lack of options.

For companies

Process Automation

Applications can ease the whole working process of companies that provide belay services. This is because they are less likely to make a mistake, lose vital documents or forget to process them. In addition, it helps them automate information updates and sending of notifications.

More Resources For Vital Needs

Since most routine processes are done automatically and don’t require human work, a business may focus on more essential needs, like creating a broader target audience, considering and implementing new features, improving marketing plans, and growing customer base.

Higher ROI

Finally, the last and probably the critical point is increased revenue. With all satisfied customers, fulfilled business needs, more time for productivity and creativity, companies ultimately get a higher ROI.

Step by step health insurance app development

- Research

Any development starts with inner market and business analysis, where you have to understand current solutions, target audience, competitors, and opportunities to enter the niche.

- Technology stack

This step is essential to understand what tech specialists you will need. Depending on the desired platform, you will quickly identify the resources required. However, we recommend either building an app for iOS or cross-platform apps, as Apple customers usually spend three times more compared to Android ones.

- UI/UX design

The UI/UX design you want should satisfy the target audience and parameters of the devices used. Remember always to hire only those designers who have already worked with such types of apps, as it will impact your further success.

- MVP building

The MVP refers to an app’s first version containing the simplest and lowest number of features. This is designed to satisfy clients’ goals, check how it works, and provide it to customers to gather needed feedback regarding its functionality.

The MVP version has to fill with the following:

- Admin panel and user profile;

- Doctor’s appointment booking;

- Secure video calls and conferencing;

- Open chat;

- Database, etc.

This MVP has to be tested on your focused group to learn about users’ interactions with the product. Once it is done, move further for a full-working application.

- Creation and testing

After you fix all issues admitted by first users, you can add other features to your product. Ensure you improved the quality of the service and packed it with the latest advancements, such as AI-powered diagnostics, IoT-based tools, VR/AR, blockchain, and Big Data technologies. When you are ready, let your QA team test it rigorously and identify if it works as supposed. Do not miss this step, as customers will otherwise admit everything, but you will get a low rating.

- Maintenance and support

Remember that it is not enough to build a software and send it to customers, as both Android and iOS providers are constantly updating. Therefore, you have to stay informed regarding minor changes and always update your app within the market policy to not lose customers.

What about regulations?

If you consider insurance application development, you have to ensure the final product complies with strict industry requirements. One of the most vital guidelines you have to follow is HIPAA and HITECH. Also known as The Health Insurance Portability and Accountability Act (HIPAA) and the Health Information Technology for Economic and Clinical Health Act (HITECH), these documents are essential for any belay platform as they guarantee data protection.

This is why it is essential to check regulations in the place you live, as they vary from country to country. In addition, the development team has to be aware of these documents to safely present your product to clients with no unwanted outcomes.

Hire a trusted insurance app development company

So you are here and want to enter this billion industry but don’t know who can manage this task? Hire Interexy as a trusted development partner, and do not lose your chance to grow revenue every day. Whether you want to invest in these solutions or you are a company that requires a platform for higher functionality – we’ve got you covered.

Since our launch, we’ve always been big fans of the healthcare space, taking any challenge arising. This is how we met our client – MedKitDoc, who has already gained numerous users and improved ROI within only a few months after the first MVP was released.

Alongside deep knowledge of all necessary guidelines in this niche, we also provide cross-platform mobile app development services, AR/VR, blockchain, big data, and fintech technologies implementation. So if you are looking for a company, you can trust, consult our experts and get your application for market success.

Conclusion

Such a promising and large market as health belay requires convenience, flexibility, and modernization. Applications have already become an efficient way to support excellent customer experience and build new ways of further improvements in this niche. So it can be safely said that building a mobile application is a win-win strategy that will help your clients get quality health belay while allowing you to be competitive and make revenue easily.

FAQs

What Are Health Insurance apps?

These products give customers access to health records on the go, helping them to manage their medical needs and schedule visits to doctors. This app is divided into several categories and monetized differently, but the working process is generally quite similar.

How much does it cost to develop a health insurance app?

There is no simple answer for everyone, as it depends on several key factors, like resources needed, budget, complexity, location of the company, and the number of features. However, the minimum price starts from $50.000.

How long does it take to make the first MVP?

It is also hard to give a correct answer without knowing details, but in general, the first MVP can be done by an experienced company within 3-4 months.