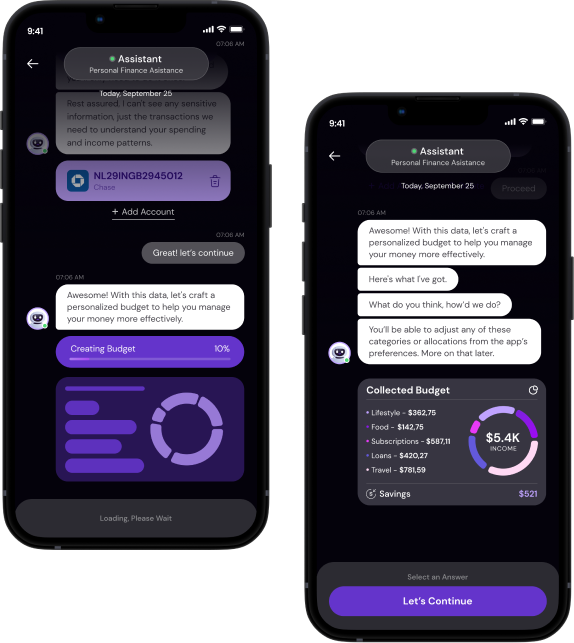

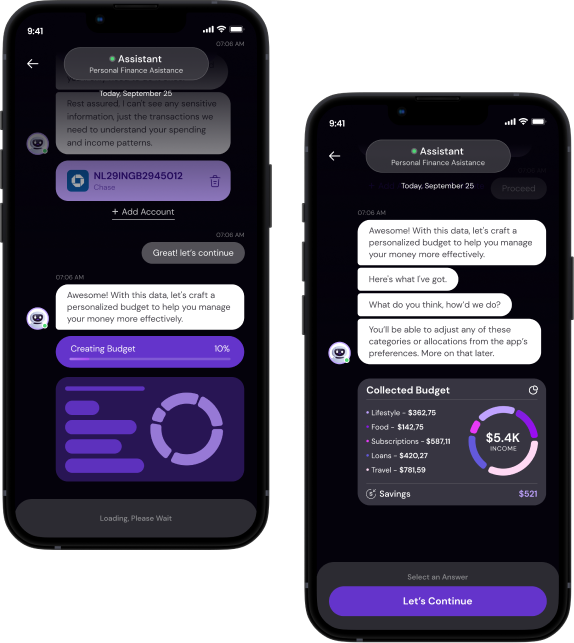

The initiative aimed to create a platform that not only simplifies personal finance but also introduces an innovative approach to capital access. The app’s core features are designed to automate financial processes, aggregating financial accounts and tailoring budgeting to individual needs.

More importantly, the key differentiator for this product is its ability to leverage personalized financial data to devise strategic debt repayment plans and offer the necessary capital (all under the same umbrella). By doing this, Gradient hopes to offer a holistic financial management experience for its end-users.