The demand for personal finance apps is surging as people increasingly seek tools to manage their financial lives more effectively. These apps offer users a convenient way of tracking spending, budgeting, saving, and investing, helping them achieve financial stability. As the market expands, developers must stay attuned to the latest trends and incorporate essential features to build successful apps. This article explores the rising demand for finance apps, key market trends, must-have features, and best practices for personal finance app development.

CAGR of 16.5%

CAGR of 16.5%

The global FinTech market size is forecast to rise from $340.10 billion in 2024 to $1152.06 billion by 2032, at a CAGR of 16.5%.

$49.9 billion

$49.9 billion

The global financial management software market size is expected to reach around $49.9 billion by 2033.

$113.7 billion

$113.7 billion

The total value of investments into FinTech companies worldwide accounted for $113.7 billion in 2023.

What is a Personal Finance App?

A personal finance app is a type of FinTech software designed to help individuals manage their finances by offering tools for tracking spending, budgeting, saving, and investing. These apps integrate with users’ bank accounts, credit cards, and other financial instruments to provide real-time updates and a comprehensive overview of their financial situation.

The rising demand for FinTech app development reflects a broader shift towards digital financial management. With the convenience of managing finances from a smartphone and receiving real-time insights and advice, these apps have become indispensable. The COVID-19 pandemic further accelerated this trend as people sought digital solutions for managing their finances remotely.

As financial literacy improves and the desire for personalized financial guidance grows, personal finance apps play an increasingly crucial role in helping individuals achieve financial stability and growth. They empower users to make more informed financial decisions, track their progress toward financial goals, and maintain better control over their financial lives.

6 Key Trends in the Personal Finance App Market

-

1 AI and Machine Learning Integration

Artificial Intelligence (AI) and machine learning are revolutionizing personal finance apps by offering personalized insights and automating routine tasks. These technologies analyze users’ financial behaviors to provide tailored advice on budgeting, saving, and investing. They also automatically categorize expenses, predict future spending, and detect fraudulent activities, enhancing user experience and security.

-

2 Chatbots and Virtual Assistance

Chatbots and AI-powered virtual assistants are becoming standard features in personal finance apps. These digital assistants help users manage their finances by answering queries, providing financial tips, and guiding them through various app functionalities. These digital assistants offer 24/7 support, making financial management more accessible and efficient.

-

3 Blockchain

Blockchain technology enhances security and transparency in personal finance apps. By providing a decentralized and tamper-proof ledger, blockchain ensures secure and transparent financial transactions. Blockchain development can also facilitate more efficient and secure identity verification processes, reducing the risk of fraud.

-

4 Open Banking

Open banking allows personal finance apps to access financial data from various banks and other financial institutions through secure APIs. This integration enables users to view all their financial information in one place, making it easier to manage their finances. Open banking promotes competition and innovation, leading to more advanced and user-friendly financial apps.

-

5 User-Centric Design

A user-centric mobile design is critical for the success of personal finance apps. It ensures the app is intuitive, easy to navigate, and engaging, enhancing user satisfaction and retention. By incorporating user feedback into the design process, developers can address real user needs and pain points, creating a more effective and personalized financial management tool.

-

6 Gamification

Gamification uses game-like elements to make financial management more engaging and enjoyable. Features like rewards, badges, and progress tracking motivate users to achieve their financial goals. By making financial tasks fun, gamification increases user engagement and encourages better financial habits.

Explore our FinTech services and see how we can help you achieve your business goals

Let's talkMust-Have Features of a Personal Finance App

Core Functionalities

-

Budgeting and Expense Tracking

The ability to track expenses and create budgets is fundamental. Users should be able to categorize their spending, monitor their budget in real time, and receive insights on improving their financial habits.

-

Financial Goal Setting

Setting and tracking financial goals is crucial. Whether saving for a vacation, building an emergency fund, or planning retirement, the app should help users define and monitor their progress toward these goals.

-

Real-time Notifications and Alerts

Real-time notifications and alerts inform users about their financial activities. Alerts for upcoming bills, low balances, unusual transactions, and achievement of financial milestones help users stay on top of their finances.

-

Bill Management

Effective bill management features allow users to organize and track their bills in one place. This includes setting up reminders for due dates, automatic bill payments, and viewing past payments to ensure timely and hassle-free bill management.

-

Secure Login and Authentication

Robust security features like biometric authentication (fingerprint or facial recognition), two-factor authentication (2FA), and encryption ensure user data remains safe and secure, building trust and confidence.

Advanced Features

-

Investment Tracking and Advice

Investment tracking allows users to monitor their portfolios and get advice on optimizing their investments. Integrating features that provide insights into market trends and personalized investment recommendations can add substantial value.

-

Multi-Account Aggregation

The ability to link and manage multiple accounts from different financial institutions in one app is highly beneficial. This feature provides a comprehensive view of a user’s financial situation, simplifying management and decision-making.

-

Data Analytics and Reporting

Advanced data analytics and reporting tools help users understand their financial behaviors and trends. Detailed reports and visualizations of income, expenses, and investments enable users to make informed financial decisions.

-

Cash Flow Forecasting

Cash flow forecasting tools allow users to predict their future financial positions based on current income and spending patterns. This helps plan and avoid potential shortfalls, providing a more transparent financial roadmap.

-

Personalized Financial Advice

Incorporating personalized financial advice based on user data helps users make smarter financial decisions. This can include tailored tips for saving, investing, and managing debt, ensuring users receive relevant and actionable guidance.

Unlock FinTech innovation with our expert team.

Get in touchBest Practices for Developing Personal Finance Apps

-

Agile Development

Adopting agile development methodologies like Scrum or Kanban allows your team to quickly adapt to changing user needs and market trends. Breaking development into sprints with regular updates and iterative testing helps maintain momentum and ensures continuous improvement. Implementing CI/CD (Continuous Integration/ Continuous Delivery) pipelines can streamline deployment and release cycles.

-

Scalability and Performance Optimization

The app should be able to handle an increased number of users without compromising performance. To ensure scalability, use cloud-based services, such as AWS or Google Cloud for automatic scaling and incorporating load balancing. Moreover, implementing caching strategies and optimizing databases will prevent slowdowns during peak usage.

-

Continuous Testing and Feedback

Automated testing throughout the development process helps catch bugs early and reduces post-release issues. Using tools to gather real-time user feedback, such as in-app surveys or analytics platforms, ensures each update meets user expectations. Continuous testing also supports smoother releases with fewer disruptions.

-

Integration with Other Platforms

Ensure seamless integration with financial services, banks, and third-party platforms using secure APIs. Following Open Banking protocols (e.g., PSD2) enables users to securely access their accounts. Strong data encryption and secure authentication methods, like OAuth 2.0, are essential for protecting sensitive financial data.

-

Post-Launch Support

Providing robust post-launch support is essential for maintaining user satisfaction and app performance. Regular updates, new feature releases, and bug fixes keep the app relevant and valuable to users. Monitoring tools can help track performance and detect issues in real-time, while responsive customer support via integrated help desks ensures user satisfaction and timely issue resolution.

Adopting agile development methodologies like Scrum or Kanban allows your team to quickly adapt to changing user needs and market trends. Breaking development into sprints with regular updates and iterative testing helps maintain momentum and ensures continuous improvement. Implementing CI/CD (Continuous Integration/ Continuous Delivery) pipelines can streamline deployment and release cycles.

Interexy’s Experience in Developing Personal Finance Apps

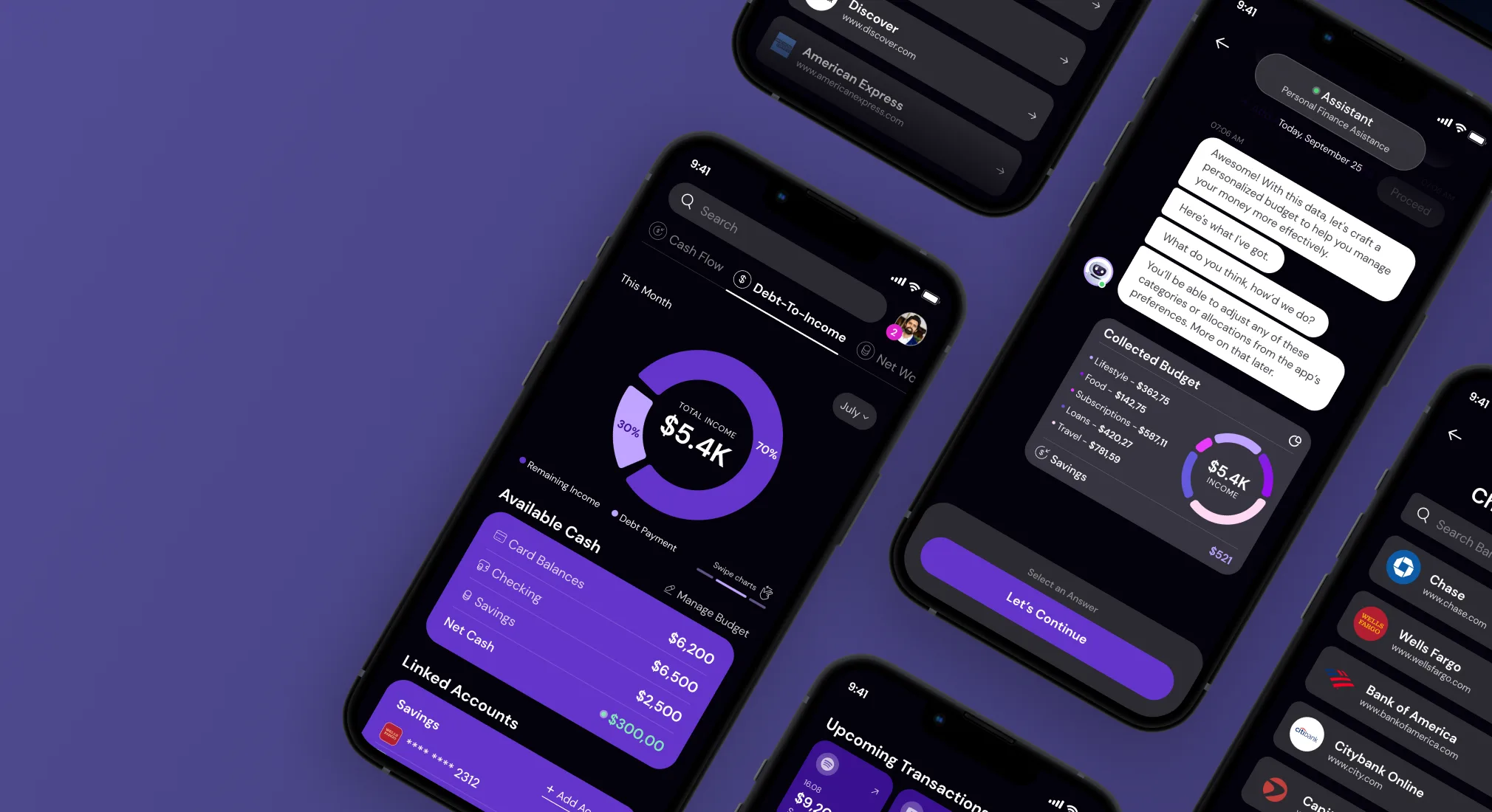

Interexy has extensive expertise in creating powerful, user-friendly financial management apps. One of them is the FinTech App, an innovative solution that simplifies financial management by offering comprehensive tools for expense tracking, budgeting, and financial planning. The app integrates with various financial accounts to provide users with a holistic view of their finances.

The FinTech app is built using a robust tech stack, including React Native for the front end and AWS Serverless Framework, AWS Lambda, API Gateway, and Prisma for the back end. With a user-centric design and advanced features like AI-driven financial insights and personalized recommendations, the app empowers users to take control of their financial health efficiently and effectively.

FinTech Development by Interexy

Final Thoughts

Building a successful personal finance app requires a thorough understanding of user needs, market trends, and technological advancements. By integrating key features like budgeting and real-time notifications and leveraging advanced technologies, developers can create powerful tools that help users manage their finances effectively. As the demand for personal finance apps grows, staying ahead of trends and focusing on user experience will be crucial for success.

FAQs

-

What is a personal finance app?

A personal finance app is a software application created to help individuals efficiently manage their financial activities. These apps enable users to track spending, budget, save, and invest by providing tools to monitor and control their finances. Personal finance apps often integrate with bank accounts, credit cards, and other financial instruments to offer real-time updates and comprehensive financial overviews.

-

What are the most important features to include in a personal finance app?

Some of the essential features that should be included in a personal finance app include expense tracking, budgeting tools, account aggregation, bill reminders, savings goals, investment tracking, financial insights and reports, robust security measures, and user notifications.

-

Why is user-centric design crucial for personal finance apps?

User-centric design ensures your personal finance app is intuitive, accessible, and engaging. It also enhances user satisfaction and boosts adoption. User-friendly interfaces make it easier for users to navigate, understand features, and benefit from the app. Moreover, incorporating user feedback addresses real needs and improves the app’s effectiveness.

-

What is the role of AI and machine learning in personal finance apps?

AI and machine learning improve personal finance apps through providing personalized insights, automating tasks, and enhancing security. Such apps offer tailored financial advice, detect fraud, predict future expenses, and support chatbots. All this makes financial management smarter and more efficient.