As we are entering the era of Metaverse and Web3, we see how many technologies and business models are evolving and believed to change the working of banks. Although Web3 will definitely reach many industries and help them grow within a few years, Web3 has significant implications for all parties involved in the banking domain now. Web 3.0 banking not only can boost the security of transactions but also seems to offer enhanced services for end users, including banking users, investment bankers, and corporates.

Key Statistics

$27.5 billion

$27.5 billion

In 2022, the Web3 cumulative market capitalization amounted to $27.5 billion.

37%

37%

In 2022, North America dominated the global Web3 market revenue, accounting for a 37% share.

$814 million

$814 million

During the first quarter of 2023, 108 Web3 startups raised about $814 million in investments.

According to the report, the global Web 3.0 Blockchain Market size is suggested to reach $12.5 billion by 2028, growing at a market growth of 38.2% CAGR during the forecast period. The speed of market growth is caused by the need for decentralization and the popularity of blockchain-based projects. Web3 offers decentralization which is being built, operated, and owned by its users. This way, it will put power in the hands of users rather than corporations.

In addition, the global smartphone penetration rate has hit 83% in 2022. DeFi users believe that identity in Web3.0 will allow a whole swathe of the worldwide population to borrow, spend, and utilize digital money. This will also reduce the need for the identity checks, documentation, or regulations traditional banks require.

And if you are running a banking business, you will soon notice that people choose decentralized finances over your services. The situation will only get worse each year. So how can you, as a traditional financial institution, interact with this new world and stay relevant? What is Web3? It is a simple answer. While more time is needed for Web3 to be used globally, you have time to explore opportunities for the new technology and see how you can benefit from it.

What is Web3?

Before moving to Web3 DeFi opportunities, let’s explore what Web3 means. Although Web3 sounds huge, the Internet won’t be replaced with a new version. It is more about adding new things to the Internet we already use. As you can guess, there were two versions of the Internet known as Web and Web 2.0.

Each has its own characteristics, and they change over time with the adoption of new technologies and tools. So what is Web3? The answer is simple – it is the next evolution of the Internet, growing out of Web 2.0.

Explore our FinTech expertise and find out how Interexy can help you!

Get in touchWeb3 Banking Opportunities

Quick Financial Transactions

In 2022, around 46% of all mobile applications using the keyword “Web3” to describe themselves were finance apps. This trend demonstrates the continuously growing adoption rates of blockchain and Web3 technologies in the financial industry.

It has never been possible to pay or perform transactions immediately in traditional banking. Settlements of transactions, which now take days, will speed up. The time will move from days to seconds regardless of the time and day. Web3 banking allows for transaction and settlement fees to be greatly reduced.

Credit Reports Based on Blockchain

Credit reports can have an effect on customers’ financial lives. However, blockchain-based credit report processes can impact customers’ financial lives even more. That is why it allows financial organizations to consider nontraditional factors when calculating credit scores.

Web3 technology allows you to get high-quality, blockchain-based credit histories. This also greatly increases consumers’ access to traditional credit services and blockchain-based loans alike. In fact, experts believe that extending financial credit services will also help automate credit lending and borrowing while also verifying credit histories in a secure way and reducing administrative costs for both parties.

Compliance at a Lower Cost

As you know, blockchain is decentralized and transparent. That is why Web3 DeFi offers transparency for all parties involved in the process while also providing full auditing and a real-time overview of essential documents that banks usually request access to. These regulators rely solely on the banking sector to manage fraudulent transactions. Therefore, blockchain solutions allow financial metadata to be added to a transaction, which makes the process of keeping records easier, faster, and more secure.

Tokenized Assets

Many well-known banks specializing in investments already use tokenization to represent custom securities, bonds, as well as other assets. Tokenization is a new trend that offers two key benefits for banks:

- Creation of bonds and securities for seamless trading.

- Smart contracts allow for self-executive trading, meaning banks can develop an algorithm that minimizes risks and maximizes returns.

Tokenization is when assets are turned into non-fungible tokens (NFTs). For example, some banks have already turned high-value assets like diamonds into NFTs.

Central Banks Support the Digital Currency

Most central banks are already working on digital currency that banks can support. Some countries develop plans to launch digital currency before crypto becomes an ultimate choice, which may be achieved in 2023. This currency is believed to be treated as bank notes under financial regulations and as fiat currency as well.

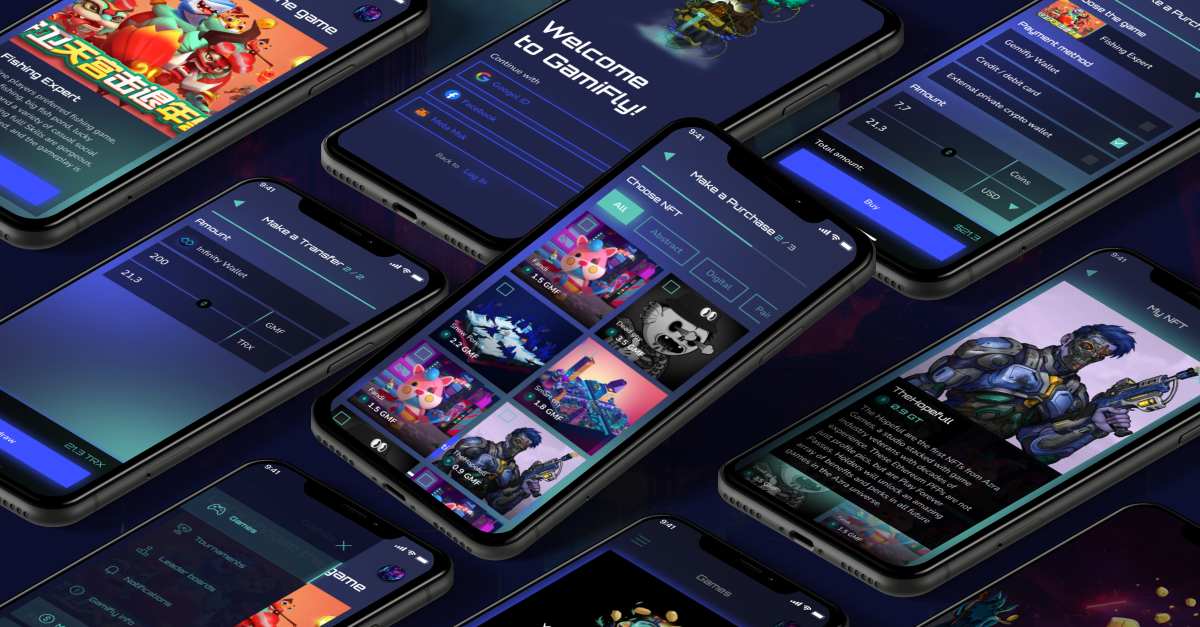

Game Monetization

Online Web3 gaming is gaining popularity at an immense speed and is projected to reach $65.7 billion by 2027. That is why banks using Web3 will be able to offer payment integration in the virtual world. Web3 neobank is a great example since it recently announced the development of a virtual exchange system that allows players to transfer value from the virtual world into the real world. The bank is responsible for holding the game tokens and lets gamers use them as a loan.

Virtual Banking

Another opportunity offered by Web3 in banking is that it can be linked with Metaverse. This way, users will be able to visit your bank in a Metaverse, interact with virtual staff and make transactions online. The immersive nature of the Metaverse allows users to interact with bank specialists more comfortably and engage from their own homes. In addition, most things that we usually do offline, like planning, financial reviews, and virtual portfolio reviews, will be possible virtually. As a result, we will also see Web 3.0 investment opportunities.

Benefits of Web3 Banking for Clients

-

Cost Reduction

Traditional banks still rely on outdated and inefficient systems in order to facilitate communication within large networks of counterparties. However, modern consumers do not like the low speed and high costs that banks require for various activities like clearing and settlement.

As a result, banks that use blockchain ledger can offer solutions that will boost speed and reduce the costs of transactions. Being a secure and efficient peer-to-peer method for data distribution, blockchain ledger has been shown to reduce inefficiencies within an organization while also eliminating the need for intermediaries and delivering significant cost savings for the industry overall.

-

High Security Levels

Banks are one of the most appealing targets for hackers today. As a result, banks have long been trying to strengthen their security systems and safety procedures to prevent data breaches. Unfortunately, even when using the latest technologies and several verification methods, banks still experience security issues, and clients are losing their money. Blockchain technology has quickly become an excellent choice for any bank looking for increased security.

FinTech organizations can bolster bank security in a number of ways. First, blockchain technology as a base of the process can be used to develop robust know-your-customer (KYC) solutions, which use cryptographic protection that ensures that all members of a blockchain network are verified. Additionally, the data can be easily shared with all members of the network, which also reduces the need for intermediaries to handle the distribution of information.

-

Instant Payments

Blockchain solutions have already started to challenge the banking space in terms of payments and other money transfers, so it isn’t surprising that many banks are already using blockchain to see what benefits it can offer. Even though the blockchain ledger is useful for both money transfers and payments, it is especially vital for cross-border payments.

In traditional banking, regular payments can take days. That is because humans can’t work 24/7, and transactions are made only when several parties approve them – a time-consuming and costly process. Blockchain doesn’t need humans to perform transactions, so they can be done at any time and day. In addition, transfers are done through smart contracts, boosting the speed of transactions.

-

Reduced Error

As we already mentioned, blockchain smart contracts automatically handle money exchange between parties. Since humans aren’t involved in the process, and smart contracts execute automatically when a set of rules is met, this approach can greatly reduce the risk of errors.

-

Decentralization

Since Web3 bank operates on blockchain, it ensures decentralization and reduces the need for a central authority and mediators. In this way, bank customers can manage and control their funds and reduce intermediary costs.

Blockchain’s decentralized nature increases the transparency of bank transactions and makes them more resistant to tampering and hacking.

-

Personalization

Web3 banking enhances the user experience and effectiveness of modern banking. Web3 in banking analyzes customers’ internet and financial activity to offer products and services tailored to their needs. As a result, clients enjoy a personalized banking experience and receive appealing financial product offers.

Personalization and customization are also achieved through accessibility guidelines, various languages, and visuals, making bank products more inclusive, democratic, and accessible.

-

Financial Inclusion

The introduction of Web 3.0 banking provides access to financial services to a broader population. Banking services reach the unbanked or underbanked communities living in rural or low-income areas with limited access to financial institutions. The same applies to Decentralized Finance (DeFi) solutions, which allow people to access financial services outside the traditional banking infrastructure.

Hire Blockchain Dedicated Team

Role of Blockchain and Cryptocurrencies in Web3

Blockchain technology, smart contracts, cryptocurrencies, and NFTs are integral for developing Web3 solutions.

Blockchain Technology

The global Web 3.0 blockchain market revenue is forecast to reach $23.3 billion by 2028.

Blockchain, as a distributed ledger, provides transparent and secure online banking procedures without the need for intermediaries. The technology’s decentralized nature ensures trust and immutability and helps conduct transactions without banks or third-party services like Google and Amazon.

Blockchain grants transparency, as users within the network can check and validate data from the blocks.

Besides blockchain, Web3 uses multiple other technologies, such as Artificial Intelligence (AI) and Internet of Things (IoT), to personalize user experience. The technologies give users full control over their data and Web3 experience.

Cryptocurrencies

Web3 in banking aims to facilitate native payments. In contrast to Web2, Decentralized Apps (DApps) and individuals within Web3 can conduct payments in cryptocurrency without turning to intermediaries like banks, payment gateways, and other centralized entities.

Various digital assets like NFTs, security tokens, stablecoins, CBDCs, and other cryptocurrencies provide additional means of payment.

The use of cryptocurrencies makes payment processes cheaper, faster, and more accessible to people living in rural or low-income areas with limited financial services options. Alternative payment methods also offer opportunities for micropayments, as they are typically too small for traditional payment systems.

Cryptocurrencies in Web3 banking also give rise to Decentralized Finance (DeFi) powered by blockchain technology. DeFi refers to a new financial technology providing users access to various financial services, including trading, lending, and borrowing. DeFi promotes peer-to-peer transactions, eliminating fees and the need for third-party intermediaries.

Cryptocurrencies are commonly used in DeFi protocols to trade assets, pay interest rates and fees, and collateralize loans.

Blockchain technology is a step forward for your business

Challenges Banks May Face with Web3 Implementation

-

Accessibility

Accessing the Web3 platforms could be a tricky task for some users. Even if you adopt Web3 into your banking projects, you may lose some customers who are not able to access your services or products. That is because of their location, the device they use, and so on. Web3 needs more time to become accessible.

-

Security

We are closing the gaps of Web2 step by step. Since web standards have been agreed upon, companies have started using standards and approved payment methods, so users have become less worried about its security. But Web3 is a new era, and regulations will only be developed over time, so early adopters of Web3 banking can face security issues.

-

Education

It took many years for companies and users to learn to use the web. Imagine how hard it could be for some users to adjust to new realities. And while Gen Z will be able to learn about Web3 faster, some users will need much more time, and, of course, you will have to learn faster as well.

How Can Interexy Help?

Being the leading blockchain app development company in Dubai & Miami, we offer DeFi development services. We know how fast the market moves and want to deliver the highest quality in the market for each and every client. Since it could be hard to follow trends and the latest technologies for business owners, we always share our ideas on software improvements.

Our Web3 development services cover the entire cycle of software development from scratch and are based on your unique needs and business requirements. Our teams are made up of experts in blockchain, Metaverse, and NFT industries, so you get skilled and experienced specialists to work on your project.

Wrapping Up

Web3 is a hot topic in the tech world. While it is still a concept, some industries should consider how to adjust to new realities, and one of the key domains is banking. Offering a more secure, fast, and decentralized ecosystem, Web3 banking can benefit both users and banks if they are ready. Book a call with our experts to discuss your project and explore how we can help!

Do you still have questions? Our experts are always available to help you.

Schedule a callFAQs

-

How Web3 in banking will shape the future of finance?

Web3 in banking will reduce the need for intermediates and offer a decentralized financial system.

-

What is the potential of Web3 in banking?

Web3 will have many opportunities for banks, like fast transactions, reduced costs of transactions, increased safety, tokenized assets, game monetization, and more.