While it may not be obvious, real estate is one of many industries that can and already benefits from blockchain ledger. Blockchain can represent a better way to run a real estate business than existing protocols.

Key Statistics

$18.2 billion

$18.2 billion

Real estate tokenization global market is expected to reach $18.2 billion by 2032.

CAGR of 19.8%

CAGR of 19.8%

Real estate tokenization market is forecast to grow at a CAGR of 19.8% by 2032.

$33.53 billion

$33.53 billion

Web 3.0 global market size is predicted to amount to $33.53 billion by 2030.

Blockchain technology is gaining momentum now. While it was first built for the crypto market, its safety, transparency, and decentralized nature allows businesses in several domains to boost their working processes. For example, blockchain technology can improve the framework’s overall transparency while also legalizing the government-mandated real estate transaction record.

One of the most exciting ways blockchain benefits the real estate industry is through the digital securitization of real estate properties, which is known as real estate tokenization. Digital assets can be anything from real estate to governance rights. When you tokenize those assets, they can be easily divided into more granular pieces, which makes them accessible to a wider pool of investors to be used to raise capital.

Although some companies in the real estate domain have already powered their businesses with blockchain, it is unclear what is going on in the market and why this technology is becoming so popular. This guide will explain the market changes and showcase the most exciting blockchain benefits in real estate to watch for in 2023.

What Is Blockchain?

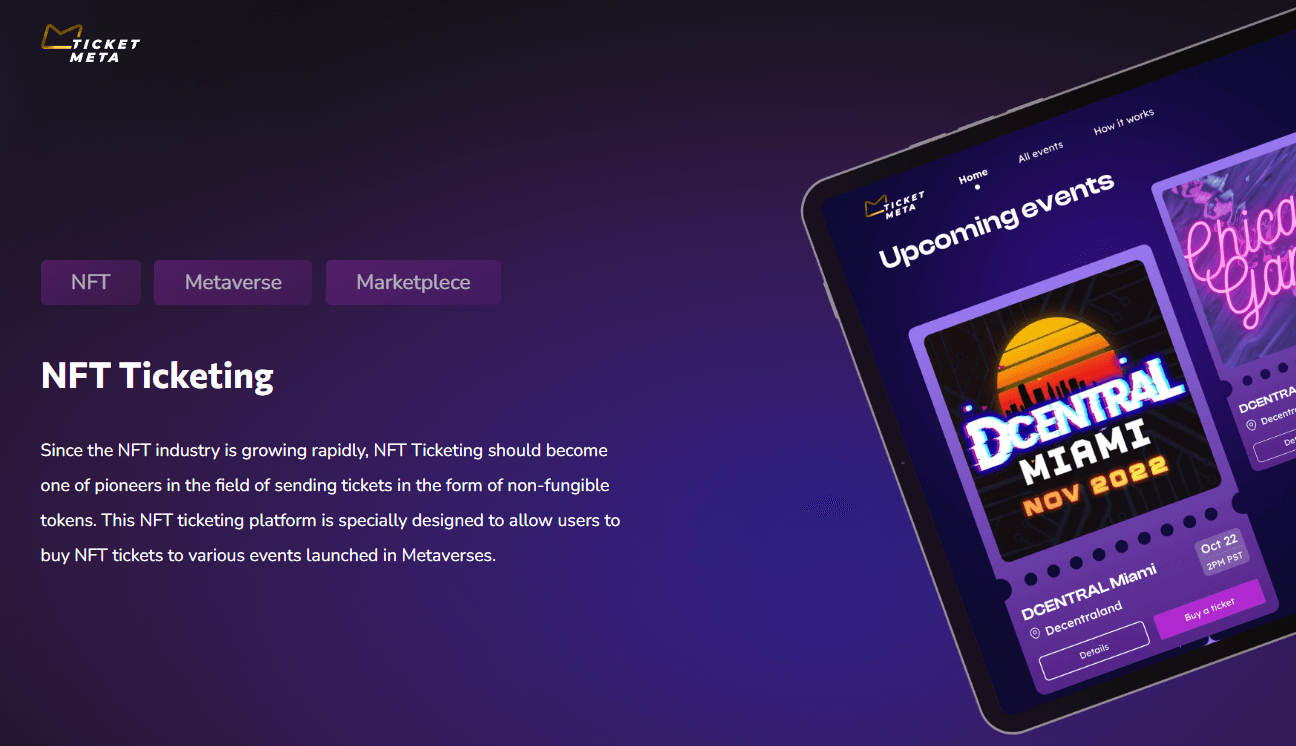

Before diving into the topic, we’ll briefly discuss what is blockchain in real estate. Considering the metaverse and NFTs’ popularity, the blockchain ledger is what helps facilitate digital real estate transactions, which are usually done through bitcoin or another cryptocurrency.

To put it simply, blockchain is a trending technology that allows for the secure and permanent storage of a digital, public ledger of all transactions stored in a “block” publicly available in several peer-to-peer databases. These databases are called “chains.”

But how does blockchain relate to the real estate industry? First of all, blockchain works as a reliable source for both parties participating in a deal. That is because it offers a secure, decentralized way to record, access, and transfer ownership of digital assets by storing all transactions, contracts, and other vital data together in the network.

Blockchain technology allows transactions in real estate to be done within seconds, as opposed to weeks or months in the case of traditional real estate.

Related: Hottest blockchain trends to watch for in 2023

4 Challenges in Real Estate that Blockchain Can Solve

Lots of Paperwork

Real estate is known for its high volume of paper rok required for the transaction. Transferring the property is long, complex, and time-consuming, so even software tools can’t speed it up. As a result, real estate companies often lose money and potential clients while becoming side-tracked from their key objectives.

Blockchain technology has been shown to resolve this issue. The technology allows real estate companies to say goodbye to the tedious paperwork and keep all vital data in one secure and transparent place.

Poor Transparency

The real estate industry is not for everyone. That is because it involves multiple factors like cash demand, citizenship, credit score, and accreditation. There is no database containing all the information required to buy or sell a property. Traditional methods do not offer transparency and affect buying and selling decisions.

However, this problem can be solved with blockchain for real estate since it offers high transparency and keeps all data recorded in one place. Now businesses can make the work more transparent while also availing the perks of advanced tech.

Several Intermediaries

Everyone knows that the real estate industry involves a lot of intermediaries since business owners have to deal with multiple daily tasks. This affected the entire process, making it longer and damaging quality.

For example, two parties are participating in the real estate business, so they involve a third party to get the work done faster. But with blockchain, all these tasks can be done by technology.

Blockchain is known for its ability to reduce the need for any intermediaries to be involved. This technology can greatly resolve one of the key challenges that most realtors faced before blockchain was used in real estate.

Lower Transaction Speed

Thanks to the number of intermediaries involved in the process, the real estate space always struggles with poor transaction speed.

According to the survey, around 44% of travelers fix an appointment with realtors before going abroad. It lowers the speed of the process, which damages the transaction rate. Blockchain use in real estate can make transactions two times faster.

Want to know how blockchain can help your real estate business?

8 Benefits of Blockchain in Real Estate

-

The Real Estate Tokenization

One of the most popular uses of blockchain technology in real estate is asset tokenization. Tokens are usually a particular number of shares for some real estate assets that can be bought, issued, and transferred through blockchain platforms with cryptocurrencies. Blockchain technology here helps to speed up property sales and lowers crowdfunding barriers.

It is worth mentioning that this system allows for reducing the barrier for ordinary property investors. It also allows overseas investment in commercial real estate to become more manageable. To put it simply, real estate properties can now be traded like a stock on exchanges.

It is believed that blockchain will revolutionize the entire commercial property market since it can increase real estate liquidity.

-

Smart Contracts

The blockchain technology used in the real estate industry can also benefit companies thanks to smart contracts. Smart contracts, which are already used by financial and banking domains, are one of the leading and most profitable blockchain innovations. Since real estate should constantly handle numerous transactions, smart contracts can also benefit this space.

Thanks to blockchain technology, a property transaction that has long involved nearly endless paperwork can now be done digitally and quickly, where only buyers and sellers participate. And this transaction will have higher transparency and security than ever before.

The key thing here is that smart contracts do not require human interaction to be done. Once all agreements are met, they are self-executed and automated. Since no people are involved, and less effort is needed, it also allows for cost reduction and zero chances of fraud.

Due to smart contracts’ complex nature and importance, it’s vital to conduct smart contracts testing to ensure the quality of its source code.

-

Security and Control Over Transactions

As we mentioned, blockchain use in real estate leads to reduced chances of fraud. It is a common practice where you are selling a property to an unknown person or trying to buy a property from someone you don’t know, so there is no reason for you to trust them blindly. Luckily, blockchain technology real estate reduces the need for third parties to participate in the process and ensures all transactions are done securely.

Extensive documentation and the need for various intermediaries to participate in the process have existed in the real estate industry for so long, but now the situation is changing dramatically. That is because the real estate industry found out that all those factors led to slow, expensive, and opaque modes of financing for property transactions.

One of the key benefits of blockchain in real estate is that it allows streamlining payments and increases the security of real estate transactions.

-

Property Management Automation

The use of blockchain technology in real estate will also reduce paperwork and manual work by property management automation. All tools and software products that have long been used now can be replaced with betterment and up-gradation.

One decentralized application containing blockchain-based smart contracts for real estate will improve the property management process, bringing efficiency and automation. It will also allow for cost reduction and less time needed for administrative tasks.

-

Transparent Data Tracking and Analysis

Blockchain uses ledger technology that lasts as the network is running. As a result, all data on the property, transactions, or the history of the building is recorded, making it readily available for future owners and investors. Blockchain allows both parties to agree on terms based on data.

In addition, some companies combined blockchain and big data, which allows accurate tracking of client and owner histories within borders and banks. It reduces the chances of fraud and default.

-

Improved Liquidity

Real estate is typically considered an illiquid asset, as it can’t be sold quickly without a significant loss in value. However, blockchain technology can substantially increase the liquidity of real estate through real estate tokenization and fractional ownership. This will make the property more affordable and attract more investors.

Blockchain provides transparent and reliable records for any property, enables and secures multi-signature contracts, and eliminates extensive paperwork.

Blockchain also increases liquidity through cross-border transactions and mitigates issues connected with international payment systems and currency exchange rates. This way, properties that might otherwise be limited to local or national markets gain international exposure and interest.

-

Elimination of Intermediaries

Real estate has always been a sphere with multiple mediators – brokers, agents, property managers, lenders, attorneys, assessment experts, etc. Blockchain-powered platforms directly connecting sellers and buyers of property will eliminate real estate intermediaries and high commissions for their services.

This will affect title companies, as blockchain-based systems can automatically verify the legitimacy of the title transfer. The technology can also eliminate third-party transaction validators, saving time, money, and energy spent on transaction closing.

Together with intermediaries, blockchain eliminates relatively high additional fees, encompassing expenses on property evaluation, applications, lawyers, etc.

Blockchain implementation will cut out the mediators, manage a secure database of property records, automate the payment process, and increase transparency and accountability.

-

Fractional Ownership

Blockchain enables fractional ownership, meaning multiple parties share a property’s expenses and ownership. In this way, several investors can pool their resources and buy a share of a property they wouldn’t have been able to buy independently.

Blockchain technology contributes to decentralizing and democratizing the real estate investment process. Blockchain facilitates transparency and accountability for all parties involved.

Fractional ownership and blockchain enable easy and quick transfer of ownership and property to new owners. Investors can sell their ownership share anytime. The investors are also spared from self-management of real estate, like maintenance and lease.

Blockchain in real estate expands investment opportunities and provides various sources of investment.

Maximize your company's performance with blockchain in real estate

Contact usWhat are the Blockchain Use Cases in Real Estate?

-

Asset and Real Estate Funds Management

Blockchain can supplement real estate tokens with data regarding ownership rights and transaction history while ensuring regulatory compliance of asset issuance, distribution, and transfer. For instance, blockchain can control that tokens are only transferred to certain counterparties or are not transferred at all during a lock-up period.

- Accelerates the creation, issuance, and exchange of assets;

- Reduces costs;

- Decreased minimum investment amounts;

- Administers dividends;

- Introduces innovative features;

- Expands secondary market opportunities;

- Manages other corporate tasks.

Digital assets (or tokens) can be tailored to meet the requirements and demands of issuers and investors, reducing the counterparty risk.

-

Alternative Financing Options

Blockchain helps blockchain real estate startup and property development firms raise finance for their new projects. In this way, the firms avoid high interest rates of banking institutions and don’t need to manage crowd financing of multiple loan sources.

Blockchain in real estate:

- Provides various alternative financing options for real estate blockchain projects;

- Facilitates investor management for real estate developers;

- Ensures transparent blockchain real estate investment;

- Provides ROI monitoring for investors;

- Simplifies investor experience;

- Increases investor confidence;

- Grants access to a broader pool of investors.

-

Mortgage and Loans

Loans and mortgage management in real estate is connected with such issues as unstandardized and paper-based loan origination and underwriting processes, double-pledging of assets, and settlement delays due to cash reconciliations.

Blockchain helps verify information, exchange data securely, monitor transactions, and settle payments in real-time. A digitalized loan or mortgage supports future decision-making, as it contains relevant information regarding ownership rights and payment history.

Smart contracts can help collect and distribute payments to beneficiaries and report to regulators in real-time. This provides investors with proof of asset performance and increases confidence in secondary markets.

-

Property Management

Large property management companies sometimes control their global portfolios inefficiently. Blockchain implementation can:

- facilitate secure data sharing;

- streamline the collection of rentals and payments to property owners;

- provide due diligence and financial evaluation of the entire portfolio.

This saves time and money, increases operational efficiency, and supports better decision-making by generating richer data.

-

Land and Property Registries, Sales, and Reassignment

Land documents are still paper-based, which makes them vulnerable to mismanagement, fraud, and loss. Besides, transferring ownership and issuing permits are associated with lengthy and costly legal procedures, sometimes resulting in land being locked in unproductive use.

Outdated paper-based documents are replaced by digital assets stored and monitored on the blockchain. The immutable ledger becomes a secure, shared repository for records for multiple blockchain real estate companies and organizations.

Blockchain makes property ownership and transaction records more accessible, which in turn:

- increases investor confidence;

- facilitates market transactions;

- unlocks access to finance;

- promotes economic and social community development.

-

Digital Identity

Creating blockchain-based digital identities for tenants and investors can significantly simplify the KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures. The technology streamlines background checks, enhances security, and reduces costs.

For instance, blockchain allows landlords to confirm their identity, prove ownership of properties, and share the necessary documents, like identity cards or passport, credit histories, proof of insurance, etc., with other parties.

-

Payments and Leasing

Leases can be signed and paid using blockchain, eliminating the need for manual reconciliations. Smart contracts can automate various payments to property owners, such as rentals, dividends, and fees. Blockchain technology significantly simplifies the payment process and improves the interaction between landlords, tenants, and service providers.

-

Accounting

Blockchain automates and accelerates various accounting processes, such as recording cash flows and property ownership. It also facilitates the preparation of annual financial statements, including statements of cash flows, the balance sheet, and income statements, and enables their real-time audit.

Blockchain in real estate accounting benefits asset owners, improves investor relations, and contributes to the development of regulatory requirements.

Blockchain can supplement real estate tokens with data regarding ownership rights and transaction history while ensuring regulatory compliance of asset issuance, distribution, and transfer. For instance, blockchain can control that tokens are only transferred to certain counterparties or are not transferred at all during a lock-up period.

- Accelerates the creation, issuance, and exchange of assets;

- Reduces costs;

- Decreased minimum investment amounts;

- Administers dividends;

- Introduces innovative features;

- Expands secondary market opportunities;

- Manages other corporate tasks.

Digital assets (or tokens) can be tailored to meet the requirements and demands of issuers and investors, reducing the counterparty risk.

What is the Future of Blockchain in Real Estate?

In the traditional market, people interested in buying, selling, or renting houses contact different property dealers in the housing market. The property agents connect interested parties to organize further communication.

Considering the current market transformation, people can now go to real estate websites and mobile apps to look for properties based on their preferences in terms of house type, location, price, house size, etc.

Back in 2018, 93% of people participating in the survey said they use websites to look for houses. And only 7% of those people said they do not use websites for house hunting, according to the Statista report. With the number of websites and apps available for this purpose, there is a high chance of a property being sold or expired yet still existing on websites, making the process long, inconvenient and incomplete from time to time.

Blockchain technology is an excellent way to solve this problem. It helps make browsing easier and more efficient for real estate investors and sellers. Sellers will be able to enter property details once into a decentralized blockchain database instead of putting all data each time on new platforms.

In addition, blockchain is believed to bring decentralization into our lives. We have been using centralized networks for almost everything we need up until now. Centralized networks have a single central authority responsible for the use of the network. For example, social media platforms like Facebook, banks, etc.

Blockchain provides decentralization which will be crucial for the real estate market. That is because the data will be stored on multiple computer nodes rather than under one authority. The information will also be encrypted using a hash algorithm. This will improve the efficiency of the data input, protect transaction details from unwanted access and provide needed transparency that the real estate market lacks.

How Can Interexy Help?

Interexy is a trusted blockchain development provider and web3 development company. We offer well-thought-out blockchain app development services for various industries, including real estate. Thanks to our expertise in the field and a team of developers with trending skills, we always deliver the expected results and help real estate organizations power up their businesses.

Since we always stay informed regarding trends that appear in this domain, we were among the first companies offering real estate tokenization services allowing clients to tokenize their properties for higher liquidity and easier transactions.

Explore our Blockchain expertise and find out how Interexy can help you!

Book a call with our expertsWrapping Up

Blockchain technology is definitely changing the future of real estate. It makes transactions more secure, transparent, and efficient. By offering decentralization and streamlining the entire real estate transaction process from start to finish, buying and selling properties will become twice easier, faster, and more cost-effective.

If you are wondering whether blockchain can benefit your business, book a call with one of our experts!

FAQs

-

What is blockchain in real estate?

Blockchain is an immutable decentralized digital ledger. In real estate, it acts as a reliable and secure database and repository of all data regarding transactions, contracts, and ownership of digital assets. The technology allows the parties to verify and accelerate transactions and provides security and independence from third parties.

-

What are the revolutionary benefits of blockchain in real estate?

There are numerous advantages of blockchain. It makes the real estate industry more efficient, secure, and transparent. The technology prevents fraudulent activities and reduces the need for intermediates. Blockchain boosts the speed of transactions and automates payments. Real estate tokenization increases the liquidity of real estate assets and enables fractional ownership.

-

How much does it cost to develop a blockchain app in real estate?

The cost depends on many factors but usually starts from $50,000 with simple apps and from $70,000 with medium app complexity.

-

What are the blockchain use cases in real estate?

Blockchain in real estate provides alternative financing options, such as real estate backed cryptocurrency, and automates payment and accounting processes. Real estate tokenization simplifies the management of assets, real estate funds, and properties. Blockchain offers new investment opportunities by creating digital identities for tenants and investors and introducing fractional ownership. The technology also helps manage mortgages and loans securely and efficiently. Blockchain streamlines and simplifies working with land and property registries, reassignments, and issuing permits.

-

What challenges in real estate can blockchain solve?

The value of blockchain in real estate is significant, as it reduces manual and paperwork, providing a secure data repository. It offers high transparency and security. The technology eliminates intermediaries like agents, brokers, assessment experts, etc. Blockchain accelerates transaction processing and automates payments.